by tomnora | Aug 6, 2014 | Business Development, CEO Succession, early stage, founder, Revenue Growth, Scalability, startup, Tom Nora, venture

“Creativity takes courage.” –Henri Matisse

This is one of my favorite quotes about innovation, by an innovator who is still revered 100 years later; it’s the first thing you’ll see if you go to my personal website http://tomnora.com/ . Matisse was an amazing innovator, and his innovation and originality

Innovation, Originality, Creativity – why are these things so important in the tech startup world? And what do they have to do with art or painting?

I have the opportunity to visit many secondary and tertiary startup markets in my travels, meaning not Silicon Valley or New York, and one of the things that always strikes me is the lack of originality in almost every company pitch I see or hear.

I can see that the entrepreneurs I meet are sincere, have usually put a ton of work and pride ion their invention or product. Often they have put a fair amount of personal or family capital into the venture (these days that’s usually their parents money).

The major flaws in their planning process are denial and ego fortification – they don’t do enough homework to see how many are already doing something similar because they don’t really want to know; and they highly overrate themselves as amazing entrepreneurs. This is a bad combination for success, but I see it daily.

I get it; I know it’s more difficult than ever to build a real career and easier than ever to start a company. But the very core of creating an interesting and new business should be the concept of originality. Some originality, enough to be different, unique, without being too weird.

Real originality comes from within, because it is inspired, comes from adrenaline and emotion, not from a spreadsheet or desire to merely make money. Finding the mid point between originality and capitalism is what I define as business innovation.

There’s nothing new under the sun, so you must critically modify, hack, or turn sideways existing systems with a truly new vision. Instead of just copying or slightly modifying something you see, try to take it a few steps further.

One of the quite innovative methods Matisse and his peers used was finding inspiration from other skills they already knew, leveraging their expertise as craftsmen. Matisse was a draftsman, a printmaker and a sculptor, and you can see these influences in his paintings.

Part of the magic of great business innovations is knowing which rules to break. Matisse broke some of the rules, but kept many intact. The rules about the way business processes flow are too often just accepted, but if you can analyze them, find an achilles heel, then innovate a better answer. Get rid of the obsolete rules without breaking the good ones, and great things will happen. It’s about where to hack and where not to.

I went to a pitch fest in one of those secondary markets the other day. Most of the presentations were weak delivery, boring, been done before and uninspiring. But there was one that was pretty amazing, by an 18 year old who had become deaf at 12. He has developed an exercise system for handicapped people; you tell by his excitement and thought process that he was inspired, and created true innovation. He wasn’t polluted by how corporations work or the rules of business – he was still in high school.

Another Matisse quote is “There are always flowers for those who want to see them.” Look carefully, take the extra time and find the uniqueness in any idea you want to realize – it’s there. Find me on twitter at @tomnora

by tomnora | Feb 26, 2014 | AdTech, Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Launch, SaaS, Scalability, startup, startup CEO, Tom Nora, venture

Here are a few traits to try to emulate if you want to be a successful startup guru. Success may be financial, fulfillment of a life goal or even altruistic. Success will begin to create itself if your heart is in the right place…

Take a look at the 9 things below and send me feedback on your thoughts.

1… Genuineness, honesty.

2… Humble openness to feedback. When I returned to LA in 2011 after being away for many years, I was smacked in the face by the volume of young startups that were in their first stages; and many of them sought me out. After a bit I noticed a dangerous trait in many of them – a false confidence and no ability to hear constructive criticism. The attitude was “just give us funding” even though I could see several fatal flaws that they couldn’t.

Being closed to feedback in itself is a sign of bad health, a fatal flaw. You don’t take all advice given to you of course, but you listen to it, calibrate it, mix it in with everything else you know that they don’t. You also have to know whom to spend your time with, many of the wrong people will want to offer advice, mostly for the wrong reasons.

3… A set of doctrines. It’s almost corny to see in many companies; they’ve worked out an internal lexicon, code words, project names to make things more unique and understandable. It speeds up communication. It

4… Taking everything from 90% to 110%. This is one I often see in looking under the hood of successful startups. It’s like a beautiful restored car that has every detail perfected when you inspect it further. The wiring, the upholstry, the under carriage – all the little details that most never see. In startups there is a beauty when you see these little things. I can think of many startup companies

5… Belief in the Idea. Belief that you have something unique, that the world, or part of the world, really does need this new thing/method/service. This is a key factor in many of the successful kickstarter products.

6… The journey is the reward. The #1 request I get from would be entrepreneurs startups is ” how do you do it, what does it take to build a successful startup, what should I do differently? They want all of these answers in one sitting, over lunch, and then want to go off and pour them on top of their startup like syrup. Great questions, but it doesn’t work like that. My answer is this… Get up every morning, work very hard (see 3. 90 to 110) make the best decisions you can, cry a little bit, then do it again the next day. Do that for several months continuously. Enjoy the process with its imperfections, if nothing else you’ll create a rhythm for yourself and your team.

7…Self Confidence. This is the most important trait of all. Unyielding confidence, an authentic, real confidence that comes from deep down inside is what takes you through the bumps and setbacks. Think of a topic you know that you have down cold. Nobody can tell you you don’t know this.

Not false confidence, that will do the opposite and cause failure.

8… Location. Being located in the right ecosystem helps foster self confidence; you know it can be done there, there’s success in the ether, those ahead of you help you make things happen, critique you,

9… 5 Best Friends. You want 5 people in your business-sphere that you can go to, brainstorm with, respect, and drive your progress. They must be influential, cognizant, and you must reciprocate, pay it forward. Don’t compromise here. If you don’t have 5 then go find them.

Contact me at t@tomnora.com

by tomnora | Feb 20, 2014 | Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Launch, SaaS

Last week I witnessed again the difference between 2 people meeting in person compared all other forms of communication we currently employ.

Last week I witnessed again the difference between 2 people meeting in person compared all other forms of communication we currently employ.

It’s amazing to see the power of the connection between 2 people in proximity to each other. In the startup world, it seems to be winning over the bits and bytes style. I’ve discounted the value of face to face recently as much as anyone, leaning heavily on asynchronous electronic communication for much of my business and personal life, and even using broadcast communication (twitter, Facebook, LinkedIn, Pinterest, email, …) to replace individual communications. But we all should rededicate ourselves to the face-to-face – the random, the first time, the networking, the required, the “have a good weekend”. Connecting on LinkedIn or FB is great but usually leads to few subsequent actual interactions. Apple’s face time is bridging the gap nicely, but still isn’t the same. Meetup.com and Eventbrite, founded on this principle of meeting in person as a response to too much Internet meeting, has helped to spawn, grow and change thousands of startups.

So, back to last week – at a startup mixer I was walking past someone headed to my seat, and we kind of got stuck in the crowd face-to-face. He had on a name tag, I didn’t. We couldn’t move. So he stuck his hand out to say hello, and we wound up talking for 10 minutes and definitely made a bit of a connection. We found several things we had in common, most people do. Since then we have met and emailed and referred business to each other, all from a semi-random meeting.

We never would have connected otherwise. If we saw each other on the street or lived on the same block we probably would just walk on by. So get out there, go to things that you like and are interested in. Barriers will melt. @tomnora

by tomnora | Dec 28, 2013 | Business Development, CEO Succession, founder, Revenue Growth, SaaS, startup CEO, Tom Nora

Maximizing shareholder value: The goal that changed corporate America – The Washington Post.

via Maximizing shareholder value: The goal that changed corporate America – The Washington Post.

by tomnora | Oct 18, 2013 | Angel Investor, CEO Succession, early stage, founder, Hawaii, PHP, SaaS, Scalability, startup CEO, Tom Nora, venture

http://t.co/LkQ7kDluf0

via 5Q03: Puneet Agarwal (True Ventures) on pitching investors, maker culture, and big trends he\’s watching. — The Orchestrate.io Blog.

via 5Q03: Puneet Agarwal (True Ventures) on pitching investors, maker culture, and big trends he’s watching. — The Orchestrate.io Blog.

![Silicon Valley Uber Alles? I think so… Some of their Secret Weapons.]()

by tomnora | Sep 11, 2013 | Angel Investor, Business Development, CEO Succession, Drupal, early stage, founder, Hawaii, Jobs, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

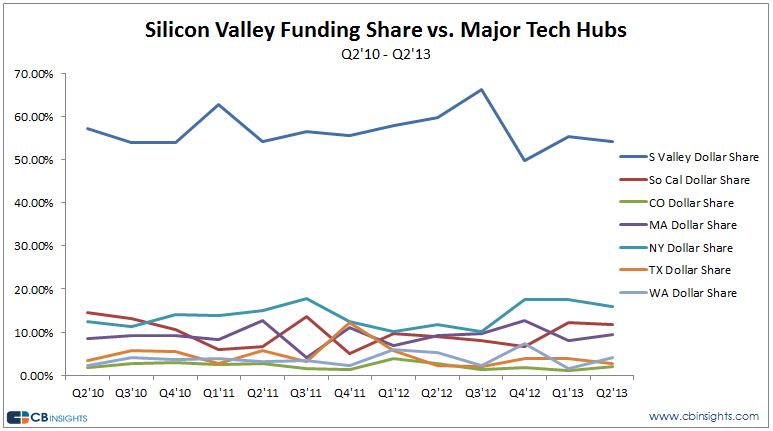

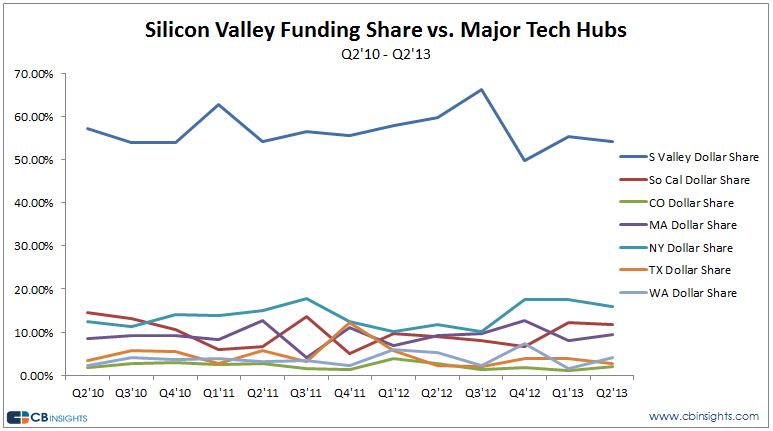

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora