![Silicon Valley Uber Alles? I think so… Some of their Secret Weapons.]()

by tomnora | Sep 11, 2013 | Angel Investor, Business Development, CEO Succession, Drupal, early stage, founder, Hawaii, Jobs, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

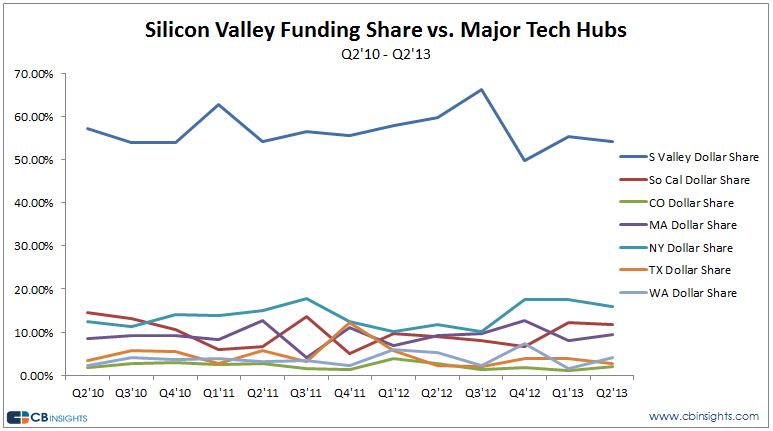

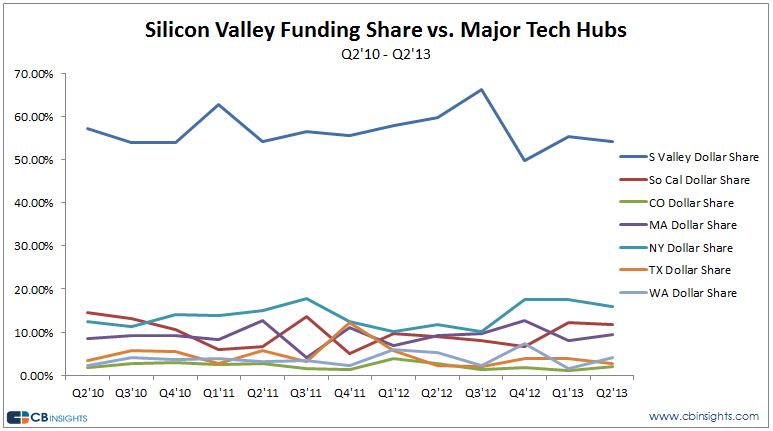

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora

by tomnora | Jan 19, 2013 | Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Revenue Growth, Scalability, startup, startup CEO, venture

Most startup entrepreneurs focus on one thing throughout the lifecycle of their company: bringing in CASH. C-A-S-H. Cash through investments, revenues, borrowing from F&F, VCs, convertible notes, deal terms, angels, etc. All of these things are magical words to early stagers. I attend and host many meetups and conferences for startups, and consult to several startups, and every founder is inevitably talking about Cash. Cash on Hand, The next Round, we just need $XXX,XXX. Cash, Cash, Cash.

A different way to improve your cash situation is the indirect one – reduce Friction Costs in your ecosystem with peripheral influencers.

In Silicon Valley, Boston, Boulder and a few other places, the growth of the startup world has vastly been enhanced over the past 10 to 30 years by professionals who are not VCs or developers or entrepreneurs – they’re the Accountants, Attorneys, Consultants, Professors, Marketing firms and others who have tremendous influence over VCs, Angels and prospective customers. They are trusted, fairly impartial, focused, big picture and practical. They’re also critical to the processes of business.

If you want to make money rain from the sky, nurture these people with sincerity over long periods of time, not just when you need them. They decrease the friction in doing business by connecting the right people, finding the quickest path between 2 points, making warm vs. cold introductions and telling entrepreneurs when “it ain’t gonna happen”.

So find some of these people and get to know them – here are 10 things you can do:

1. buy them a cup of coffee

2. be real with them, when you don’t need anything.

3. Help them out with something they’re working on.

4. Read What Would Google Do? by Jeff Jarvis.

5. Join my meetup group; you’ll find many of them there and can connect no matter where you live: meetup.com/Startup-Workshops/

6. Invite them to speak at an event you’re hosting.

7. Contact me and I’ll help you find and meet the right people.

8. Create something very cool, nothing gets attention like that.

9. Be a connector. Connect 2 people without any self interest; I do this almost daily.

10. Become an authority on the flow of cash in startups, a very valuable skill.

Tom Nora

by tomnora | Dec 14, 2012 | Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

Being the CEO of a startup is crazy, fun, very hard work, inclusive, humbling and of course can be quite rewarding. Weekends are meaningless. There is a continuous decision stream where each decision informs the next. Your mind is thinking 24 hours a day, even when you sleep.

When you’re the CEO of a startup, a real startup with product and some cash in the bank and/or revenue, there are 3 FULL TIME JOBS.

1. Raising Money – you are constantly doing this, preparing for this and thinking about this, whether it’s pre-seed, seed funding, debt, revenue, partnerships, IPO or other.

2. Managing and Properly Growing The Business – this includes several things, depending on the size of the enterprise: managing employees, administration, hiring, firing, leases, expenses, unhappy employees, fixing other problems, etc.

This piece is what often kills an otherwise great business, which justifys the case for less is more when it comes to employees and infrastructure.

3. Selling – The CEO of a startup must ABS, always be selling. You start every day working this, just like #1 above, they’re closely related. Using the CEO to close sales no matter what size the business is, is vital to success.

This piece emphasizes the importance of having an awesome, mature VP of Sales, if you can afford it; it takes a lot of pressure off and frees up the time of the CEO.

Overall, it can be the most exhilarating experience you’ve ever had, especially when things work. And it’s more accessible to most people than ever before. But it’s not for everyone – you must decide what your #1 goal is. If it’s to create a successful long term business, being the CEO should be something you’re willing to give up if it threatens goal #1. If your #1 goal is to try it out to see how it feels, then by all means do it, get professional help, and make the most of it. Contact me if you’re dead serious and I can help you. The Startup CEO by Tom Nora