5Q03: Puneet Agarwal (True Ventures) on pitching investors, maker culture, and big trends he’s watching. — The Orchestrate.io Blog

http://t.co/LkQ7kDluf0

http://t.co/LkQ7kDluf0

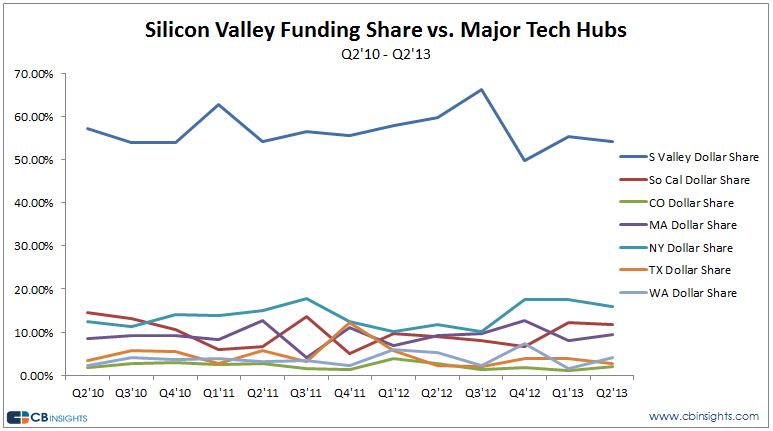

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora

Dave McClure should be thought of more as a movement leader than asking how he negotiates. He doesn’t really have to use any tricks, the whole thing is a brilliant maneuver. Remember, this thing didn’t exist a few years ago.

By design his operation is humble (I know, I’ve lived on Castro Street twice!). He created a new layer for people to get a shot at launching a Silicon Valley start with some cash and mentoring that they never would have otherwise had.

Negotiate? He could be more hard-ass but isn’t. He could wear contacts (or real shoes) but doesn’t. He created his own ecosystem that spreads out all over the world now, and even used some of his own money.

The environment allows people learn how to negotiate. And to fail softly if they fail, which is almost critical to later success.

500 startups went from strange idea to an integral part of the world startup ecosystem. Not many major players are not involved or connected in some way. One of the things Dave doesn’t charge for in his valuations is the connections to that world, and for that he will surely make everyone involved a bit of a winner.

Tom, this is a great endorsement; however, doesn’t address the question set, being fair, honest and easy going is not a negotiation tactic. I think you are suggesting he is a partner style of negotiator, i.e. looking to find common ground before determining the valuation opportunity…

One key weapon VCs use is the threat of walking away from the deal at any moment. Dave pretty much takes that one off the table before starting the negotiation, giving an advantage to the green entrepreneur.

A classic trick is “all the deals are the same here, therefore there’s really nothing to negotiate” which is never true, but works often.

@tomnora

After a recent speech I gave for startups, I was interviewed by Jennifer DesRosiers (love that name!) about tech startups. Here are my answers…

When did you first discover your love of technology?

>> When I was a 11 my brother built a homemade crystal radio. It was fascinating to see him assemble these inert parts and then hear sound come out. From then on I was hooked on technology and electronics.

What is your favorite part of your job?

>> The unknown factor, the challenge to create the future and make something grow from nothing.

What sparked the idea for NeoRay?

>> The original idea for me came from seeing people use their cellphones to buy from vending machines in Japan. Simultaneously Alessio watched his father create a PayPal competitor and he wanted to make something more futuristic for mobile payments; he then saw a WIRED article “Kill The Password!”. We compared notes and decided the timing was right for mobile payments without passwords leveraging advances in biometrics..

What in your opinion is the next big thing in technology?

>> The 15 Minute Website and Personal Website “Portfolios” – soon anyone will be able to build multiple personal sites with full e-commerce, payment systems, community, social networking, SEO, and big data analytics with no coding and very easy manipulation. Currently there is a barrier to this – you must know some coding to optimize this and it’s difficult to manage multiple sites. People and companies will have a portfolio of websites and not even think about it.. Most of the tools already exist but need a lot of refinement; it will take another 2-5 years.

What excites/interests you most about tech startups and what makes them successful?

Most startup entrepreneurs focus on one thing throughout the lifecycle of their company: bringing in CASH. C-A-S-H. Cash through investments, revenues, borrowing from F&F, VCs, convertible notes, deal terms, angels, etc. All of these things are magical words to early stagers. I attend and host many meetups and conferences for startups, and consult to several startups, and every founder is inevitably talking about Cash. Cash on Hand, The next Round, we just need $XXX,XXX. Cash, Cash, Cash.

A different way to improve your cash situation is the indirect one – reduce Friction Costs in your ecosystem with peripheral influencers.

In Silicon Valley, Boston, Boulder and a few other places, the growth of the startup world has vastly been enhanced over the past 10 to 30 years by professionals who are not VCs or developers or entrepreneurs – they’re the Accountants, Attorneys, Consultants, Professors, Marketing firms and others who have tremendous influence over VCs, Angels and prospective customers. They are trusted, fairly impartial, focused, big picture and practical. They’re also critical to the processes of business.

If you want to make money rain from the sky, nurture these people with sincerity over long periods of time, not just when you need them. They decrease the friction in doing business by connecting the right people, finding the quickest path between 2 points, making warm vs. cold introductions and telling entrepreneurs when “it ain’t gonna happen”.

So find some of these people and get to know them – here are 10 things you can do:

1. buy them a cup of coffee

2. be real with them, when you don’t need anything.

3. Help them out with something they’re working on.

4. Read What Would Google Do? by Jeff Jarvis.

5. Join my meetup group; you’ll find many of them there and can connect no matter where you live: meetup.com/Startup-Workshops/

6. Invite them to speak at an event you’re hosting.

7. Contact me and I’ll help you find and meet the right people.

8. Create something very cool, nothing gets attention like that.

9. Be a connector. Connect 2 people without any self interest; I do this almost daily.

10. Become an authority on the flow of cash in startups, a very valuable skill.

Tom Nora