by tomnora | Nov 19, 2012 | Angel Investor, Business Development, CEO Succession, early stage, founder, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

This is a line that was pretty common in Silicon Valley until recently. Steve Jobs even (ab)used that line on Dropbox when trying to buy them out of the market (They turned him down.)

Now that’s all changed, for the moment. The threshold for “company” status is very low, including the following list of minimum pieces at their lowest cost.

1) a url – $10 2) incorporation – $200 3) Internet – free 4) build a website – free 5) development tools – free 6) office space – free – home, starbucks, hipster coffee shop

In other word, the barriers have dropped if you’re willing to do most things yourself, which is a good thing. You still need an amazing idea , business model, some focus from a developer (critical!). You can create a single feature “disposable” company, nothing wrong with that, it’s a learning experience, fail fast, etc., it might even create some value and get acq-hired. And It’s a lot better than talking to folks for a year about an idea that never materializes.

But that’s not the way to create a company that can live and grow for years. In doing that you have to be honest with yourself, make some sacrifices and seek continuous enhancement of your entity. In the world of easy startups, everything is a startup, people drink their own koolaid too much.

Here are some great ways to maybe move into higher ground:

- Seek outside criticism and listen to it. Put on your flack jacket and let ’em rip you up. Be open to changes but don’t be a wimp either. You may see something nobody else does, but listen.

- Pay those you ask to help you – money, equity, trade services, something meaningful. Give them incentive to help you think straight. Make sure you pick the right mentors with track records. Never ask for something for nothing, you’ll get what you pay for and a bad reputation fast. Better yet, pay it forward. This is an area where strong developers actually have a lot to trade these days, but usually try to do everything themselves. Not likely to succeed.

- Diversify – get people difeerent than you involved as team members – different genders, races, ages, expertises. Here’s a great 3 minute talk on this by Stanford prof Kathy Eisenhardt http://j.mp/UaVjky

So look for the opportunity to build a company, share the wealth, and seek higher ground.

follow me or DM me @tomnora

![Facebook shares upon IPO March 2012]()

by tomnora | Nov 18, 2012 | Angel Investor, Business Development, CEO Succession, early stage, founder, Revenue Growth, Scalability, startup CEO, Tom Nora, venture

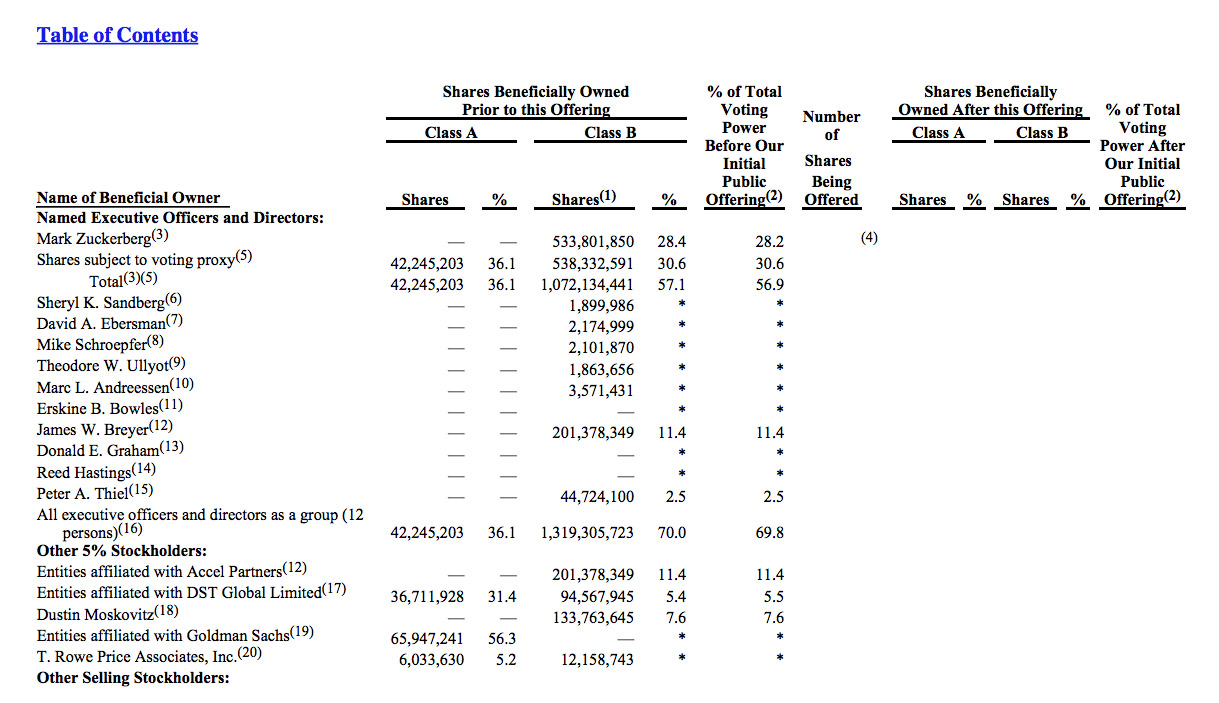

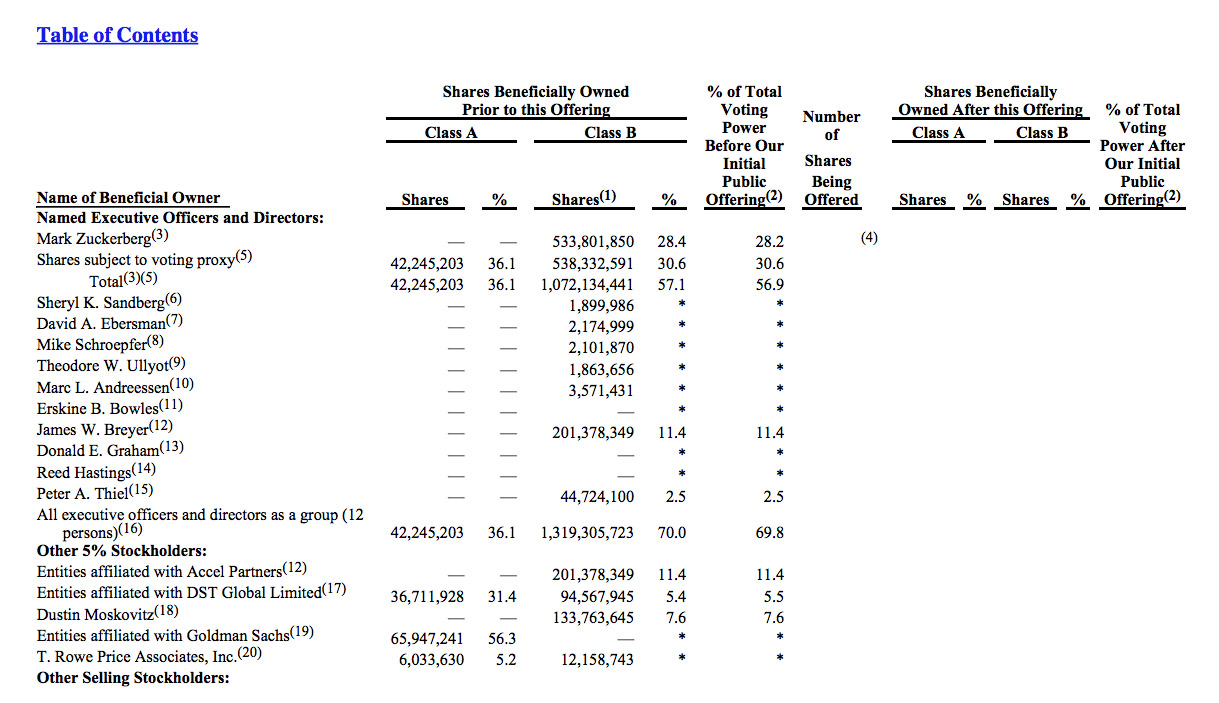

Here’s the stock ownership of principals at Facebook at IPO time earlier this year, interesting to see Mark Zukerberg’s amount vs. others.

by tomnora | Nov 15, 2012 | Angel Investor, Business Development, CEO Succession, early stage, founder, klipsch, Revenue Growth, startup, startup CEO, Tom Nora, venture

Entrepreneurial Thought Leader Highlights by Stanford University | Stanford / Entrepreneurship.

via Entrepreneurial Thought Leader Highlights by Stanford University | Stanford / Entrepreneurship.

by tomnora | Oct 14, 2012 | Angel Investor, Business Development, CEO Succession, early stage, founder, klipsch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

How to design a board of directors

By Tom Nora

There was an article recently in VentureBeat about how much control the startup CEO founder has over his/her board of directors. Unfortunately, this actually isn’t true in most cases, especially for first time founders, for many reasons.

Many factors come into play in early board formation including the founder’s goals, investors, cofounders, early appointees, family, friends. A well designed board can be the critical driving force in making a startup successful; while the wrong board can create disagreements, misdirection, angry members, awkward board dismissals, power struggles and can actually bring a company down.

First time founders usually aren’t sure how to populate the board, and first money from FFF (friends, family, fools) blinds them a bit to their best instincts.

Typical Pre-Funded Board

Here is the typical order of board formation before any professional funding comes in:

1. Founder/CEO

2. at least one Co-Founder

3. FFF

then maybe…

3. a “grown up” – former boss, relative, early (non-professional) investor

4. industry luminary

This is the group that must help grow the company properly, attract professional funding and make industrial strength business decisions. Most of this 1.0 group don’t have much experience, i.e. what it means to be on a board, how to optimize it, what the points of leverage are, what a natural disagreement is vs. a problem of discord. Usually the group is not experienced or cognizant enough to optimize this asset early on.

A Better Way

Here I’ll lay out some key steps to making this organization an asset rather than one with little to negative value.

Step 1 – The Founding Team

It’s fine to have the founder and maybe one cofounder on the board; after all that’s all you have to draw from. The key to success here is to STUDY the topic, learn everything you can, follow proper board.

Also, internally you can determine if and when you actually have something worthy of funding – you must have a real business that is operating – product(s), spreadsheets, a team, Revenues?; asking outsiders to get involved too early can be the kiss of death. I see this happen a lot.

Step 2 – Get Outside Help

In any startup ecosystem these days there are many people who have an interest in your business. The word “Startup” now gets their attention. Among these people are professionals that can get involved as a board member, but how do you do it? Which ones should be advisors instead? Are there consultants that help with this? If you’re near Stanford or in San Francisco, every other person you meet almost seems appropriate, but don’t be fooled. You want people who are qualified but also who come to you via an organic process – you read about them, stumble upon them, meet them.

Listen to these signals. For example, in Los Angeles right now the problem is that a majority of those you meet fall below the level of “qualified” – they’re out there networking but have never sat on a real board or led a startup. Keep asking around and you’ll find the right people. And remember, make sure you have a real company first.

Contact me if you have a going company and this is a hole for you, I’m one of the people I mention above who can help. But not if you just have an idea, or are thinking about starting a company, those are a dime a dozen.

by tomnora | Aug 10, 2012 | Angel Investor, Business Development, CEO Succession, early stage, founder, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora

1. The Executive Summary

I often get inquiries about getting involved in early stage companies here and around the country.

The beginning point to discussing a startup the Executive Summary of the company, which lays out the key facts about a startup in 1-2 pages. But I’ve noticed that in L.A. it’s the exception rather than the norm, people want to meet first. Real investors don’t usually work that way.

The Executive Summary is CRITICAL to getting prospective investors excited. Without it you have little chance of getting the next step – a meeting to discuss the project and funding, more team members, more ecosystem. It’s a key qualifier as a serious player in the startup world. You hardly ever see a Silicon Valley startup without one, no matter how early stage.

The pitch deck has replaced it lately, but that takes more time to read and it’s harder to find the key info quickly. (One exception to this is the deck Hank Cho sent me; one of the best I’ve seen in a while.)

So google “Executive Summary”, look at several and put one one together. Send it to me and I’ll critique it for you. Make it less words, more impact, numbers, facts, the team.

It will also show where your holes are.

1. Let’s Loosen Up

The current startup scene combined with our poor economic/job situation is causing many people to panic a bit. It’s understandable, but if it transfers to your persona as a startuper, it won’t help. Many people I meet are very rigid, look a little scared but fake a smile, unable to open themselves to criticism. This doesn’t get investors excited.

Sometimes a 20-30% change or add to your business can make a major difference. Not a complete pivot, that implies 90-180 degree change, but be open to suggestions by those who’ve been there before. Maybe change your name, change your graphics(!), merge/acquire/acq-hire, drop yours for another better one.

Let go of your ego, let go of some equity.

The goal is to build long term sustainable businesses and revenue streams. Add smart people to your circle for the bigger good of the company. Loosen up, smile, have fun. But make some money for everyone involved. Be better.

@tomnora

by tomnora | Jun 30, 2012 | Angel Investor, audio, Business Development, CEO Succession, early stage, Hawaii, Launch, startup, startup CEO, Tom Nora

About a year ago, during a speech I was giving for a Hacker News group, someone in the audience brought up the notion that “Failure Is Good”, i.e. Fail Fast, Fail Often. This is a major change in thinking from the past, due to many factors, and it makes a lot of sense. Rapid prototyping of web apps and mobile apps now means rapid prototyping of startups.

Since everything in life is becoming an app and MVP is good enough to actually attract revenue and/or funding, you can actually try something and throw it away within a few weeks. The cost for this is from $0 to $5,ooo.

The problem is when someone tries this over and over with the same result – junking it. I see a lot of this in my circles There is a price for doing this; you wer yourself out, lose credibility, waste peoples money and time, lose friends, etc.

A better option is to vastly improve your odds each time by getting smarter, refining, capitalizing on mistakes, getting help in the areas where you’re weak, have less ego and more focus on not accepting failure.

If you add up all the attempts to launch startups over the past 2-3 years by all participants, there are probably at least a million failures. Many of these were stepping stones to better things and/or a quite valuable learning process, maturity, personal growth. But over half were probably unnecessary ego bursts and fleeting ideas where deep down inside the founder knows it ain’t gonna happen but keeps going for many reasons.

Most people are very good at one thing at a time, not five so pick ONE and try that role and let as many others as possible help prevent failure number one million and one. @tomnora