by tomnora | Nov 3, 2014 | Drupal, Jobs, startup

Here’s the first part of his note and his bio:

Tom, I need a job. My background is corporate finance and I’ve worked for the best electronic parts wholesale, a top three cable company, and the #1 online bank (PayPal).

And my response:

Eric, I see a lot of people going through this, myself included. Times are worse than I’ve ever seen if you’re not already in a great position. The idea of j-o-b has become harder to get, you have to think in terms of your own brand instead. I’m actually writing a book about this right right now.

It looks like you have lots of energy, and you’re reaching out, you need to channel it into $$$. Also, Avnet is a great background to have.

I usually see everything as a startup, so you look like a finance startup to me. I’ve spent a lot of time recently in the world of e-commerce, it’s an mazing market growing quickly. I’d focus on that if I were you.

Here are some thoughts:

– Are you currently working at PayPal? You could be a paypal consultant and have a pretty strong business.

– E-commerce technologies are very hot right now

– check out commerceguys.com (Drupal)

– woocommerce (WordPress).

Within those companies or similar have many job openings. Or, expertise here can get you some type of work.

– Keep networking and stay positive, negative attitude will scare people off.

– Start a blog about your experience and about online finance. That will help.

– give before you get. Find ways to help others before approaching them asking for something.

I could list plenty more, but that would probably just frustrate you. None of the above is a job, they’re all just ways to hustle to try to get a job.

Let me know how it goes.

TN

I could rubber stamp this answer to many people I hear from ,but usually I don’t even answer. In looking for a higher leverage way to solve this, I’m using my channels to try to broadcast this topic and help many at once.

Job boards are broken, resume robots are broken, so real humans need to get back into the process. If you want to be involved contact me; otherwise, stay tuned here for more. TN @tomnora

by tomnora | Aug 26, 2014 | Angel Investor, Drupal, founder, PHP, Revenue Growth, SaaS, Scalability, startup, startup CEO, venture

As further market proof of the power of Drupal in the enterprise, Acquia has received about $100 million in funding in the past 3 months, which puts its valuation at over $1 billion.

http://j.mp/nora-acquia

There’s a lot of buzz about the Amazon acquisition of TWITCH this week. As a personal friend of the original investor, I’m very happy for this transaction – after 7 years of work, repositioning, and sticking to it their vision has paid off. But that’s a different article…

Less prominent in the news, but possibly more important, is Amazon’s investment in ACQUIA. Acquia, Inc. is the for-profit company founded by Dries Buytaert, the inventor of Drupal, to support his open source project. Drupal was launched in 2001, and Acquia started in 2007. When Open Source software projects are launched, the progenitors often start a for-profit sister company to garner some income from training, support and consulting. Because they are open source. the original products can’t generate revenue, so when these OS projects occassionally blow up into phenomenons like Drupal and WordPress have over the past few years, it’s gratifying but also quite frustrating to watch others derive so much value from your baby while you toil away to lead its growth with no financial return. Plus, there are tons of expenses like servers, bandwidth, office space, travel and the time of many professionals.

Red Hat was one of the first of these types of companies bridging open source with big finance, leveraging Linux support into a profitable business, also leveraging the enterprise. They kind of invented this business model. Sun Microsystems and others almost made it happen, but they were only semi-free. Google has optimized this open source to freemium model in almost all of its products.

But Drupal has succeeded way beyond it’s original expectations. It was originally started as a college dorm project, where many of the best products on the web seem to hatch. It gained recognition during the 2004 presidential campaign when Howard Dean’s IT director decided to use it as a platform for community and campaigning. After that it quickly gained credibility and spread throughout government, and corporate America.

Drupal is now driving some of the largest and most critical websites in the world, including The White House, The Oscars, Twitter, Mercedes Benz, Warner Music Group, The Louvre Museum, The City of Los Angeles and Stanford University. Over its 13 year life the web has vastly changed from primarily static pages to dynamic database driven automated (“rendered”) web page serving, which Drupal excels at. The average website size has also greatly increased, aided by automated rendering systems like Drupal and others. The term Content Management System has become mainstream in everything from the Fortune 500 to small businesses.

Some of Drupal’s success has come from luck, but most of it has been because of strategy and excellent timing. Dries has carefully pushed the technology not to the bleeding edge, but towards the modern edge where enterprises are comfortable. He and his team have avoided many temptations to try new fads, make big changes and try to grow faster. Currently they face enormous pressure to innovate faster, and are responding with Drupal 8, which will incorporate many new modern web architectures previously not part of the Drupal platform.

Acquia has been critical in supporting, guiding, enhancing and positioning Drupal for the past 7 years. It was a startup that launched with funding from day one and has never looked back.

Amazon’s motivation in buying into Acquia is a bit more self serving. Acuia provides premium, high security, supported hosting to it’s customers, which all runs on top of Amazon AWS. Amazon can see that some of AWS most robust and challenging work comes from Acquia with Drupal. For example, Acquia runs its Drupal infrastructure on more than 8,000 AWS instances and serves more than 27 billion hits a month (or 333TB of bandwidth). Amazon has a strategic value beyond many other companies or VCs in their investment.

What will come next? Will Amazon try to acquire all of Acquia before the inevitable IPO? I think we can bet on that.

This is a very contemplative time for Buytaert – he has fierily protected Drupal’s independence and strategic positioning, taking risks but protecting his large customers from drama, can he keep Amazon and Bezos at bay? I have no doubt he will, for he is a true “Startup CEO”, even though his title is CTO at Acquia.

@tomnora

more info on the funding round from @thewhir http://j.mp/nora-acquia

![Silicon Valley Uber Alles? I think so… Some of their Secret Weapons.]()

by tomnora | Sep 11, 2013 | Angel Investor, Business Development, CEO Succession, Drupal, early stage, founder, Hawaii, Jobs, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

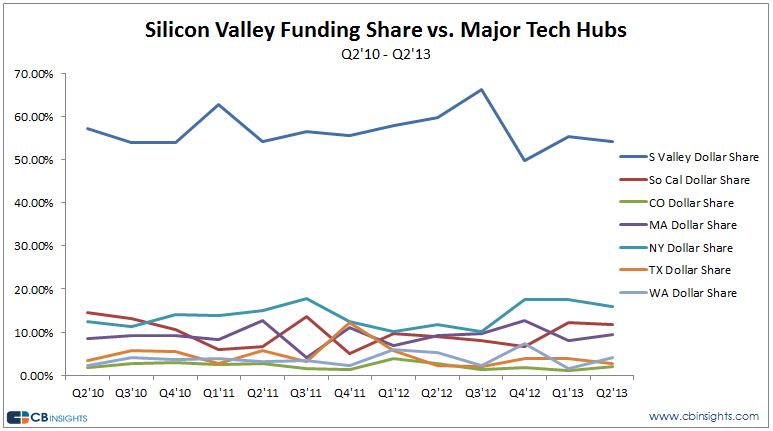

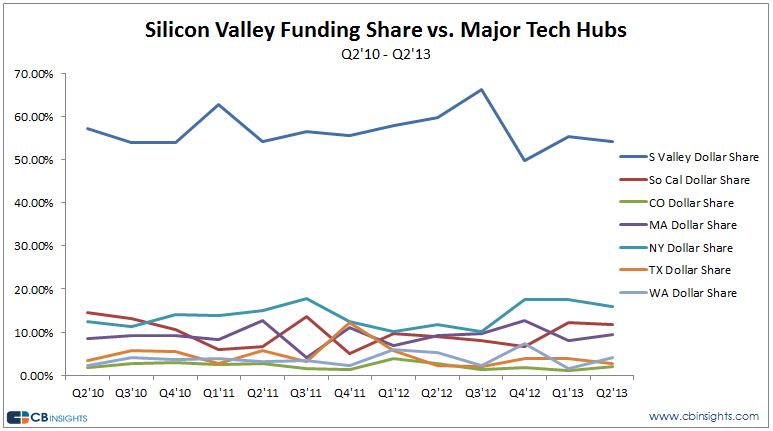

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora