5Q03: Puneet Agarwal (True Ventures) on pitching investors, maker culture, and big trends he’s watching. — The Orchestrate.io Blog

http://t.co/LkQ7kDluf0

http://t.co/LkQ7kDluf0

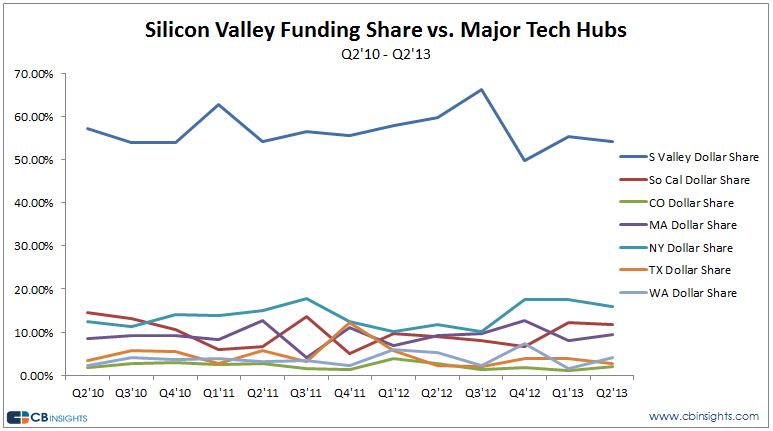

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora

This has organically happened a couple of times for me – someone I’ve worked with in the past asks me to write them a recommendation and then spontaneously returns the favor. It’s a very cool gesture and it reinforces the relationship for the future.

Below is an example for a startup entrepreneur I just went through a short mentoring process with, Greg Weinstein. Greg will do very well with his company, I could’ve written a lot more about his attributes.

I recommend (get it?) you try this – swap a recommendation with close present or past colleagues; it will enhance both of your social business circles and create new connections.

It’s hard to derive extra value on linkedin, rise above the fray – this will help you do it.

#networking #linkedin #social_marketing

– – – – – – – – – – – –

Gregory A Weinstein has recommended you on LinkedIn

Gregory A Weinstein

Gregory A Weinstein Founder and CEO, One Fulfilling Life

To: Tom Nora

Date: August 22, 2013

Gregory A Weinstein has recommended your work as Founder, Marketing, Community Development at Startup Workshops.

Dear Tom,

I’ve written this recommendation of your work to share with other LinkedIn users.

Details of the Recommendation: “During the early and critical stages of the conception and start up of One Fulfilling Life, Tom provided us with thoughtful, wise and nurturing insight and guidance. He was our “Board of Directors” and the fit seemed very natural and intuitive.

It was an awesome opportunity and I relish the experience. His guidance saved us a lot of time and money and more importantly kept our momentum moving forward in the face of what could have been crippling obstacles. If your a tech start up and especially if this is your first business venture Tom’s your man. Catch him if you can!!!!!

Thanks Tom”

Service Category: Business Consultant

Year first hired: 2013

Top Qualities: Expert, Praxis High Integrity Systems

Dave McClure should be thought of more as a movement leader than asking how he negotiates. He doesn’t really have to use any tricks, the whole thing is a brilliant maneuver. Remember, this thing didn’t exist a few years ago.

By design his operation is humble (I know, I’ve lived on Castro Street twice!). He created a new layer for people to get a shot at launching a Silicon Valley start with some cash and mentoring that they never would have otherwise had.

Negotiate? He could be more hard-ass but isn’t. He could wear contacts (or real shoes) but doesn’t. He created his own ecosystem that spreads out all over the world now, and even used some of his own money.

The environment allows people learn how to negotiate. And to fail softly if they fail, which is almost critical to later success.

500 startups went from strange idea to an integral part of the world startup ecosystem. Not many major players are not involved or connected in some way. One of the things Dave doesn’t charge for in his valuations is the connections to that world, and for that he will surely make everyone involved a bit of a winner.

Tom, this is a great endorsement; however, doesn’t address the question set, being fair, honest and easy going is not a negotiation tactic. I think you are suggesting he is a partner style of negotiator, i.e. looking to find common ground before determining the valuation opportunity…

One key weapon VCs use is the threat of walking away from the deal at any moment. Dave pretty much takes that one off the table before starting the negotiation, giving an advantage to the green entrepreneur.

A classic trick is “all the deals are the same here, therefore there’s really nothing to negotiate” which is never true, but works often.

@tomnora

In 2008 I was working on a post-merger integration project for a small company being acquired by a Fortune 100 behemoth. We looked at several SaaS based systems for accounting, sales automation, calendaring, product management, scheduling our company airplane, travel, etc. At the time SaaS just wasn’t mature enough and people at the company weren’t comfortable enough to make the change; too many old habits of installing software.

Because of this reluctance, almost every business process we depended on required the manual intervention of humans. The difference in efficiency between then and now is pretty amazing.

Today, only 5 years later, almost every task we performed then is gone, a complete turn over of an industry. These are now done either transparently in the background, in the cloud, or done using minimally invasive mobile apps. Spell-guesser, auto-fill, travel, accounting, calculating company valuations, facebook, pinterest, dropbox, codecademy, me writing this blog are all managed by a SaaS platform.

PaaS, IaaS and other derivatives of SaaS are proliferating but are just that, derivatives. Today SaaS is pretty much the norm; many, many human processes have been displaced more rapidly than ever in our history. We wouldn’t be able to imagine our lives without it, auto-save, no software loads, freemuim, mobile, access anywhere. I can even build server based websites with Drupal and MySQL now on an iPad in a coffee shop.

But more importantly, the labor of moving software around by humans and physical media and even the Internet has been taken down to almost zero. The software just doesn’t leave it’s cloud hosts anymore. This saves energy, mistakes, cost, time, client computer memory and bandwidth. It vastly reduces computer waste.

SaaS is the culmination of over 20 years of changes from ASPs, client-server, the web, higher speeds, always on, mobile 2.0, cloud computing, laptops HTML5 and many more innovations to finally reach the moment we’re in now. This speed of innovation has never been seen in history – not in automobiles, education or any industry.

The way we do things today is very different because of SaaS and the Internet. 80 year olds can build a Facebook page of their family’s photos or create a new business using a cellphone because of SaaS, without ever knowing anything about the guts underneath. I wonder where it will go next, what the next big change will be to make todays capabilities obsolete. You know it will happen.

> Connect with me here and on twitter @tomnora

Audacity. Boldness. Risk Taking. Vision.

Audacity is required to build an innovative startup, to invent something new, try to do things others say you cannot do, and Southern California needs many more audacious people in its tech and media startup ecosystem. So Cal is a perfect environment for innovation and bold risk taking.

We have sunshine, 20+ Universities, a great history of tech innovation, and more idle capital than most places in the world. We also have some of the most brilliant scientists and financial minds in the world.

But audacity is different than intelligence or experience or brilliance or funding, it’s a unique form of energy and effort that is the tipping point of incredible startups.

It’s often more important than any other attribute in making the impossible happen. If you look at some of the best inventions on the Internet and throughout time, they’ve either been accidents or major audacity. In the history of Southern California, there has always been a large slice of creativity involved also.

So why haven’t we produced a Google or Facebook here? In Silicon Valley people like Ron Conway and Tim Draper sometimes write a check for $500,000 without even seeing a pitch. They base their investments on instincts, probabilities, betting on the people involved. Where are these investors in L.A.?

Southern California certainly has a history of audacious visionaries who did it – created something from nothing. Louis B. Meyer, Howard Hughes, Edward Doheny Sr., Peter Drucker, Richard Meier, Frank Gehry, Walt Disney, James Irvine, Cecille B. DeMille, Sofia Amoruso and many other creative leaders.

These people made something out of nothing, took enormous risks, lost it all and won it back. Most used all of their own money, many started with nothing. People like this are required for L.A. to ever have a chance of approaching Silicon Valley’s success machine.

In the So Cal startup ecosystem, most of the companies launched are “safe”, evolutionary extensions of current business models and features, enhancing existing business ideas around the world.

There are many cool twists, but not much in the way of revolutionary new ideas that succeed. Strange singe we are the #1 place in the world for entertainment origination in film and music. This does not attract investors from Silicon Valley. They’re looking for audacity, would rather invest in a low probability bold idea than in something “safe”.

Sometimes situations necessitate audacity, other times audacity generates the idea, the “manic” brainstorm. Audacity allows you to see beyond what others see, but requires an underlying confidence in the face of likely failure, criticism from people around you, and possibly major financial losses. Not a conservative approach.

The reason for most startup failures is that they aren’t audacious enough – they try to be too much like everyone else, they stand way back from the leading edge. Or they mistake arrogance for audacity “we can’t fail” because we know everything. Audacity is threading that fine needle between crazy and lazy.

A great and very current case study of So Cal audacity and incredible success is Sophia Amoruso, founder of the Nasty Gal clothing dot com.

At 22 in 2006, she was a junior college dropout, living with her step aunt working for $13 an hour checking student IDs.

She had no business experience, no fashion experience, no Internet experience, didn’t know what e-commerce meant and zero $ in the bank. Today she is CEO of the fastest growing retail company in the US, according to Inc. magazine, with a valuation of somewhere between $600 million and $1 billion. So where’s the audacity here?

In 2006 Sophia quit the admin job and started hunting through thrift stores for vintage jeans she could enhance and resell. Since she nothing about web design she used EBay. Not much audacity yet, many millions had tried that. Since she was in San Francisco there was lots of inventory available.

Then she did something extremely audacious – named it Nasty Gal. The name came from an album she owned by Miles Davis ex-wife and singer Betty Davis. She actually had to acquire the URL from a porn site. Most people have to do a double take when they hear the name. Audacious move #2 – her markups were insane, 10x to 100x in many cases.

She never got an MBA so she knew none of the rules of profit margin, her guide was to be bold, ask for a lot. She bought one jacket for $8 and sold it for $1,000 as a “vintage” piece. Then she moved the company to L.A. to be in the center of hip fashion commerce.

Nasty Gal even convinced a Silicon Valley VC to invest over $50 million into the company. They said “only in L.A. would we find a company like this”. In 2012 sales were over $130 million last year with $100 million net profit.

After all this success, Sophia still handles most of the marketing, using the same guerrilla tactics that have always works. Urban Outfitters recently made a bid for ~$600 million but she turned them down. Pretty bold. Remember this someone who was making $13 an hour 6 years ago.

They’re now launching their own publishing company Super Nasty; of course Sophia is Editor in Chief. So we need more Sophias here. It’s not knowing how to code; it’s audacity and confidence in the face of certain failure.

It will happen in L.A.; the proliferation of original ideas that spawn leading tech companies is just around the corner. We have all the ingredients – desire and hunger for success, migration of brilliant minds from all parts of the world to this area. Capital that is slowly getting less conservative and more audacious.