by tomnora | Oct 26, 2014 | Angel Investor, early stage, founder, Hawaii, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

How is it that so many people associated with startups reap the financial benefits, yet others just as close get no financial upside This is a source of frustration among many people in the startup sphere. Imagine if you’re in Silicon Valley right now with no equity in a tech startup, but associated with several people getting six figure “bonuses” because they somehow wound up with some stock in one.

The free parties (or not free) and swag and great stories and boat rides in the bay are nice. Sometimes you’ll even score an iPad or Apple TV, but it’s not the same as being one of the insiders.

Often as startups grow and maneuver their way through the jungle of success or failure, they have a lot of help from those around them.

Often many these people don’t have any equity or upside from their advise or moral support or money lending, or even the spare couch they let you sleep on when you were in their town.

If the startup actually makes it to an IPO, there is actually something you can do.

It’s called the “Greenshoe”. You have to be very careful about this, you can’t imply or promise anything in advance, and it only works when the company goes public, but the Greenshoe is an amazing award for those involved that don’t have equity.

The Greenshoe is an over-allotment of stock options, up to 15% of the total offering at time of IPO. You can offer these options to virtually anyone, friends, family, people who helped your company. Since they’re options, acquirers only exercise if the stock goes up, and have no downside risk or capital outlay.

Upon the IPO event, the option owner can gain the upside if the stock goes up over the initial offering price and essentially collect that difference.

I’ve used it a few times when I was lucky enough to be able to offer it to friends and family. Strangely enough, some people have declined, because they’re not sure it’s legal; they’ve never heard of it. Others have bought themselves a new Lexus with it.

Here’s more info on wikipedia:

Greenshoe

The Greenshoe should provide motivation for all of us in the startup world to try to continuously build our company steadily, continuously and profitably and to know that you can make many peoples lives a little bit better by sharing the wealth. The rewards are pretty amazing.

Contact me at

#Web #Development #Digital #Strategy #Art| tomnora.com

by tomnora | Feb 26, 2014 | AdTech, Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Launch, SaaS, Scalability, startup, startup CEO, Tom Nora, venture

Here are a few traits to try to emulate if you want to be a successful startup guru. Success may be financial, fulfillment of a life goal or even altruistic. Success will begin to create itself if your heart is in the right place…

Take a look at the 9 things below and send me feedback on your thoughts.

1… Genuineness, honesty.

2… Humble openness to feedback. When I returned to LA in 2011 after being away for many years, I was smacked in the face by the volume of young startups that were in their first stages; and many of them sought me out. After a bit I noticed a dangerous trait in many of them – a false confidence and no ability to hear constructive criticism. The attitude was “just give us funding” even though I could see several fatal flaws that they couldn’t.

Being closed to feedback in itself is a sign of bad health, a fatal flaw. You don’t take all advice given to you of course, but you listen to it, calibrate it, mix it in with everything else you know that they don’t. You also have to know whom to spend your time with, many of the wrong people will want to offer advice, mostly for the wrong reasons.

3… A set of doctrines. It’s almost corny to see in many companies; they’ve worked out an internal lexicon, code words, project names to make things more unique and understandable. It speeds up communication. It

4… Taking everything from 90% to 110%. This is one I often see in looking under the hood of successful startups. It’s like a beautiful restored car that has every detail perfected when you inspect it further. The wiring, the upholstry, the under carriage – all the little details that most never see. In startups there is a beauty when you see these little things. I can think of many startup companies

5… Belief in the Idea. Belief that you have something unique, that the world, or part of the world, really does need this new thing/method/service. This is a key factor in many of the successful kickstarter products.

6… The journey is the reward. The #1 request I get from would be entrepreneurs startups is ” how do you do it, what does it take to build a successful startup, what should I do differently? They want all of these answers in one sitting, over lunch, and then want to go off and pour them on top of their startup like syrup. Great questions, but it doesn’t work like that. My answer is this… Get up every morning, work very hard (see 3. 90 to 110) make the best decisions you can, cry a little bit, then do it again the next day. Do that for several months continuously. Enjoy the process with its imperfections, if nothing else you’ll create a rhythm for yourself and your team.

7…Self Confidence. This is the most important trait of all. Unyielding confidence, an authentic, real confidence that comes from deep down inside is what takes you through the bumps and setbacks. Think of a topic you know that you have down cold. Nobody can tell you you don’t know this.

Not false confidence, that will do the opposite and cause failure.

8… Location. Being located in the right ecosystem helps foster self confidence; you know it can be done there, there’s success in the ether, those ahead of you help you make things happen, critique you,

9… 5 Best Friends. You want 5 people in your business-sphere that you can go to, brainstorm with, respect, and drive your progress. They must be influential, cognizant, and you must reciprocate, pay it forward. Don’t compromise here. If you don’t have 5 then go find them.

Contact me at t@tomnora.com

by tomnora | Feb 20, 2014 | Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Launch, SaaS

Last week I witnessed again the difference between 2 people meeting in person compared all other forms of communication we currently employ.

Last week I witnessed again the difference between 2 people meeting in person compared all other forms of communication we currently employ.

It’s amazing to see the power of the connection between 2 people in proximity to each other. In the startup world, it seems to be winning over the bits and bytes style. I’ve discounted the value of face to face recently as much as anyone, leaning heavily on asynchronous electronic communication for much of my business and personal life, and even using broadcast communication (twitter, Facebook, LinkedIn, Pinterest, email, …) to replace individual communications. But we all should rededicate ourselves to the face-to-face – the random, the first time, the networking, the required, the “have a good weekend”. Connecting on LinkedIn or FB is great but usually leads to few subsequent actual interactions. Apple’s face time is bridging the gap nicely, but still isn’t the same. Meetup.com and Eventbrite, founded on this principle of meeting in person as a response to too much Internet meeting, has helped to spawn, grow and change thousands of startups.

So, back to last week – at a startup mixer I was walking past someone headed to my seat, and we kind of got stuck in the crowd face-to-face. He had on a name tag, I didn’t. We couldn’t move. So he stuck his hand out to say hello, and we wound up talking for 10 minutes and definitely made a bit of a connection. We found several things we had in common, most people do. Since then we have met and emailed and referred business to each other, all from a semi-random meeting.

We never would have connected otherwise. If we saw each other on the street or lived on the same block we probably would just walk on by. So get out there, go to things that you like and are interested in. Barriers will melt. @tomnora

by tomnora | Oct 18, 2013 | Angel Investor, CEO Succession, early stage, founder, Hawaii, PHP, SaaS, Scalability, startup CEO, Tom Nora, venture

http://t.co/LkQ7kDluf0

via 5Q03: Puneet Agarwal (True Ventures) on pitching investors, maker culture, and big trends he\’s watching. — The Orchestrate.io Blog.

via 5Q03: Puneet Agarwal (True Ventures) on pitching investors, maker culture, and big trends he’s watching. — The Orchestrate.io Blog.

![Silicon Valley Uber Alles? I think so… Some of their Secret Weapons.]()

by tomnora | Sep 11, 2013 | Angel Investor, Business Development, CEO Succession, Drupal, early stage, founder, Hawaii, Jobs, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

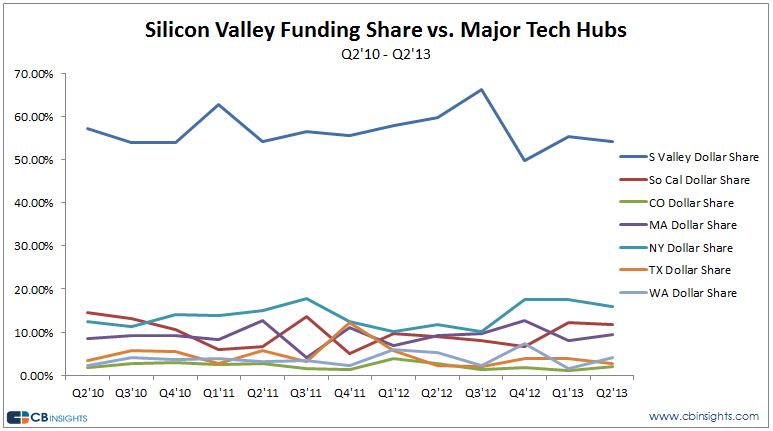

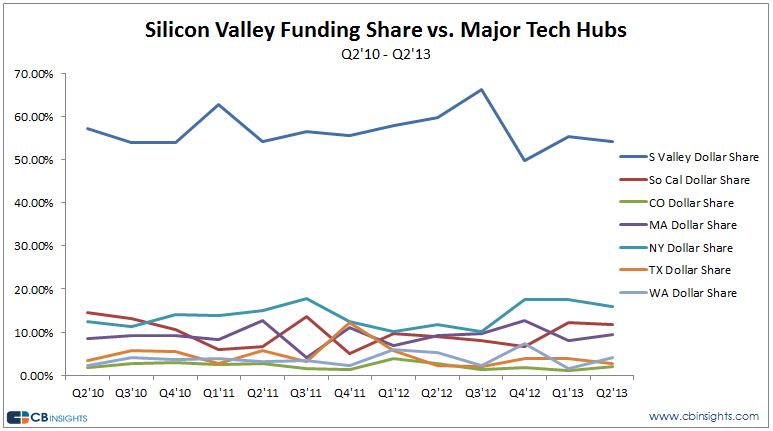

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora

by tomnora | Aug 9, 2013 | Angel Investor, CEO Succession, early stage, founder, Hawaii, Launch, Revenue Growth, startup CEO, Tom Nora

I’ve advised several founders from 500 su and they’ve all said Dave is fair, honest, easy going, and lets you know when you’re cheating yourself. Most venture capitalists will take a little advantage of naive entrepreneurs so this was surprising to hear over and over.

Dave McClure should be thought of more as a movement leader than asking how he negotiates. He doesn’t really have to use any tricks, the whole thing is a brilliant maneuver. Remember, this thing didn’t exist a few years ago.

By design his operation is humble (I know, I’ve lived on Castro Street twice!). He created a new layer for people to get a shot at launching a Silicon Valley start with some cash and mentoring that they never would have otherwise had.

Negotiate? He could be more hard-ass but isn’t. He could wear contacts (or real shoes) but doesn’t. He created his own ecosystem that spreads out all over the world now, and even used some of his own money.

The environment allows people learn how to negotiate. And to fail softly if they fail, which is almost critical to later success.

500 startups went from strange idea to an integral part of the world startup ecosystem. Not many major players are not involved or connected in some way. One of the things Dave doesn’t charge for in his valuations is the connections to that world, and for that he will surely make everyone involved a bit of a winner.

Edit

@tomnora