by tomnora | Jul 19, 2011 | founder, Scalability

From July 2011,,.

California. Most of my 25 year career has been in California; about half of those in Silicon Valley. I’ve been involved with several amazing companies throughout Northern and Southern Cal; I have expanded, launched, M&A’d, relaunched, liquidated, succeeded and failed, you name it.

I’ve also had the good fortune to operate and sometimes live in several other fledgling tech corridors – Cambridge, NYC, Portland, Boulder, Santa Fe, Austin, Dallas, SLC, Frankfurt, Paris. In every case these other places aspire to be a self sustaining baby Silicon Valley of their own – Silicon Alley, Silicon Prairie, Silicon Coast. But they don’t quite make it. Some come close, like New York or now Boulder but it’s still not quite the same.

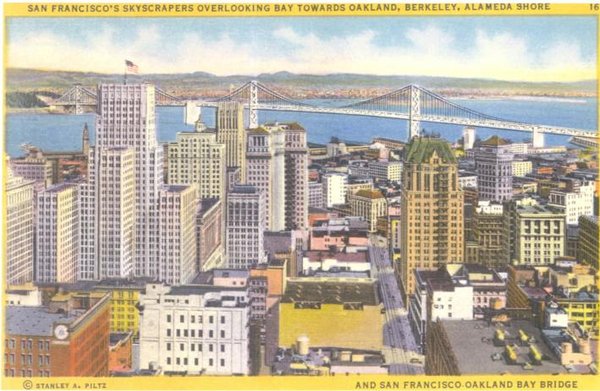

The term Silicon Valley is now a misnomer – it has moved way beyond silicon and way beyond the original Santa Clara valley to spread all over California. The new hot spots are San Francisco, Los Angeles, San Diego, the east bay, etc.

San Francisco

San Francisco has actually successfully co-opted the Silicon Valley magic and even surpassed it in some ways (Twitter, Salesforce.com); it’s again a very hot place to be right now and this will continue. Talk about scalability! If you plop your company here, great things could happen. It wasn’t always that way – in the 80’s and much of the 90’s San Fran was a sub-par runner up to SV, trying to catch up. Great PR and finance firms, but not many startups. Houses were cheaper, you couldn’t get good engineers, etc. That has all changed. Now companies have bidding wars for office space amid a major national recession.

There’s a magic and complex dynamic to the combination of things that make California so different. Just say the word and people take notice. There’s a seriousness, a buzz, confidence, reliability, completeness, professionalism. An assumption that you’ll more likely make it there.

Southern California

The “Silicon Basin” – – With the convergence of social media, the Internet, and digital entertainment, Southern California is now humming as a great startup region. In 2003 Electronic Arts actually moved their headquarters from Silicon Valley to Playa Vista, an crazy move at the time, and accelerated their growth as a result. Several smaller software groups, vfx studios and creative design labs are now benefitting from the movement south. Yahoo, Microsoft, Facebook, Google and others are growing their employee base and presence in L.A. Venture Capital from Northern and Southern Cal is flowing into the L.A. basin. It has the key catalyst – several excellent universities spitting out young engineers and business people. It has a strong and growing angel investor base, tapping one of the largest concentrations of individual wealth in the world.

There are exceptions to the California phenomenon; several amazing companies have emanated from these other areas, always have, and many of these ecosystems are now of course self sustaining, but they’re not the same as California. Countless companies have moved there for this advantage, reference Mark Zuckerberg/Facebook. Good move. If you’re somewhere else, it’s because you’ve made a tradeoff, a compromise. I know as I’ve done it myself several times and I’m glad I did. I’ve rooted for other places to approach California’s ecosystem, but I know they’ll never come close.

If you want maximum scalability for your business, you should be in California. If you the best capital providers, the best people, the highest valuations, you gotta be in Cali. You could get more advantages from a couple of visits to a coffee shop in Palo Alto than spending a year in some other town. @tomnora @cowlow

by tomnora | Feb 1, 2011 | CEO Succession, early stage, founder, Revenue Growth

I had dinner recently with a former colleague and good friend, let’s call him Al, who has recently transitioned from CTO to CEO of an early stage company he founded; he’s struggling with every aspect of his new job. Al was originally the de-facto leader through his first funding round, then at the urging of many around him recruited an experienced CEO to “take it to the next level”. Potential investors, former bosses, and current shareholders felt this was a critical step in for them to invest more time or money. The common line was “You’re not a CEO”. The new CEO was performing well, hitting milestones, preparing new funding and building the business, but he and Al couldn’t get along.

So now Al is now back in charge. This happens often in the early stages, sometimes because the new CEO is a bad match, but that’s usually just an excuse. Usually the CEO leaves for good or bad reasons, or the founder can’t let go of control of the company. In this case it was the latter. Als investors and employees are quite unhappy and he’s not sleeping much.

In hearing his frustrations I figured out his main problem – he’s having serious problems making decisions and sticking with them, which is why he brought in a professional CEO in the first place. He has no reference point for many key decisions so lacks the confidence to execute decisions. His frustration is that this doesn’t happen to him in technical matters – he’s brilliant at those decisions. Technical leaders frequently underestimate the job of the CEO or business leader in a fledgling startup. They use the logic – hey, I’m extremely smart, so marketing, sales, and business development can’t be as hard as developing an entire software platform. This is a big mistake, and a common reason why startups never get out of the gate.

I’ve been the incoming CEO several times in early stage startups, taking over for the founder. This transition is difficult to pull off, but necessary for many companies to scale. Emotionally it’s very hard for a founder to “let go” and trust an outsider to care as much as he/she does about their baby. There are also others around the founder that can feel ownership and impede the new CEO – a spouse, other early employees, a displaced senior manager who thought he/she had a shot at the job. I’ve experienced all of these situations, but I’ve also had many good experiences where I did have sponsorship and support, and succeeded.

In Al’s case, he never really committed himself to stepping aside, even though he said the words. He admits that now. In his actions he inadvertently sabotaged his new partner, changing the CEOs decisions without discussion, etc. He felt that the new CEO was making “too many” decisions. He obviously wasn’t ready. I realize that he still isn’t ready.

The reason for our meeting was to see if I was interested in the job – he feels that our long term relationship would provide the foundation for a successful transition, but I know it wouldn’t work. I explained to him what CEO means to me – the final decision maker in a company, answerable to a real Board of Directors, of which the founder is a member but not the only member. The E in CEO stands for execution, making things happen, responsible for the results. The CEO must communicate clearly to everyone involved what he/she is doing, especially if taking over the reins from a founder, but should be supported by all as the final major decision maker. If that process works, the company works. Without that authority they become ineffective quickly and are only doing portions of the job, and can’t take full responsibility; then they leave and you have to start all over.

I explained to Al two reasons why I wouldn’t join his company: 1) With all due respect, I don’t feel that he’s any more ready to let go than he was a year ago, even though he respects my abilities and has comfortably worked for me before, and 2) the company is distressed now, unhappy employees, unhappy investors, delays in both the business and technical initiatives, messy equity stakes and a decrease in trust all around. Like I said, a Big Mistake. I told him his best chance is to try to learn how to be a CEO or merge his company as fast as possible. But this one is most likely kaput.

by tomnora | Jan 27, 2011 | Revenue Growth, Scalability, venture

REPOSTED 2013

:: An ominous title for a blog post, but “Grow or Die” has been one of the most basic rules in the high-growth startup world for decades. And by growth I mean revenue growth.

The first trick is to offer something that the world will need more and more over the next few years (growing market), without that it doesn’t matter much anyway; your product/service/thing must “catch on”. This can be somewhat manipulated by your successful marketing execution (i.e. why one iPhone app succeeds vs. another).

If you do have something compelling, you’re either running as fast as you can to catch up to something bigger or to stay ahead of those below you. Lack of growth will encourage others to come along and knock you off the track, attack you; they will smell blood. Inconsistency in growth can do the same thing. Millions are currently watching boastful high flyers like Zynga, Google, and Facebook to see if they stumble. If you’re not offering something in a growth market, it doesn’t matter so much; you become either a zombie/lifestyle company or shrink slowly then die.

If you’ve got something hot, the idea is to spread your footprint quickly and prevent others from knocking you off (first mover). Growth means bigger and more complex barriers to entry – more advertising, products, support and security for your users/buyers, advanced services, etc. And protection form death. And gasoline to create more growth.

Flat to negative revenue growth is a real red flag, especially for early stage companies. Your stakeholders start to wonder what is going wrong? Did we build the wrong product? Are we becoming passé? Time for a new CEO? And all those other depressing clichés. If you’re venture funded, things get kind of ugly -unhappy board members, cut off from communications, down- rounds to keep you going, or no more funding.

Many early stage founders aren’t sure how to handle this requirement for success. What about users? Eyeballs? Hits? Press Mentions? Those are all nice and should be designed impact revenues, but usually aren’t a real measurement (unless you’re Twitter). Revenue growth must be the core strategy and drive all other strategies.

Continued growth becomes more and more difficult for larger companies, you must “feed the monster” as it grows. Many companies are currently hitting the wall after strong growth, like MySpace, Yahoo, Dell, Fedex. Even Google is starting to struggle due to a slowing growth rate, and attracting attention for this problem – losing employees to Facebook, trying across the board 10% raises, switching out their CEO of 10 years.

But the focus here is not big companies, it’s startups in their first years of revenue. Companies that hit their “first millions” then get stuck, and often panic. I was once VP of Sales for a startup that went from zero to >$10 million in one year, then back to zero the following year. Talk about panic! That’s an extremely contracted timeline for up then down the growth curve, but the general trend is not that unusual in startup land – up then down quickly. In our case we didn’t have our internal house in order, and didn’t know how to handle our sudden success – no strategic planning and thereby no adherence to such a plan.

The bottom line is that continuous growth, at a good rate, is imperative for long term scalability. If this is a hole in your business strategy, don’t ignore it. Put your heads together, hire expertise, call your advisors, revisit your business models, sacrifice sacred cows, and respect this key piece of your success.

But make sure you deal with it.