by tomnora | Aug 1, 2022 | startup CEO

First of all, if you’re a real startup CEO, these hard times aren’t so hard if you look at the right indicators. I’m interacting with startup money people all the time — angels, VCs, superangels, family offices, even some PE these days. There is still a lot of money out there, lots of deals happening. VC is still roaring, with the exception of about 2 months of fear over the NASDAQ and Crypto Crash.

The only thing that ‘s changed is valuations, and those aren’t much different than they were 2019-2021, which is pretty high.

Early stage angel investors like to find little gems before anyone else, they look for the $10 million valuation seed or pre-seed opportunities. That hasn’t change, money hasn’t “dried up”. I get angels asking me still every week for leads one early-early deals. If seed funding is good, follow on from these same investors later should be good also, unless the world falls apart over the next couple of years.

As they always have, investors do want a few things — a very strong level of belief in the founder(s), something new and not just a clone of existing businesses, and high energy from the startup.

I saw a very strong Silicon Valley angel say the other day that, for certain founders, he would give them $1 million without knowing the product or valuation, just betting on the founders he knows will win again and again. That’s the confidence and trust that prevails in the valley — today.

It’s also a testament to the power of the momentum of the current retooling of modern business. This recession can’t stop that.

So, the valuations are lower. Is that fair? Is that VC greed taking advantage of the stock market?? A little bit, but valuations, especially for mis and late stage were they too high and needed a reset. That couldn’t have gone on forever. And they’ll come back. Depending on where your company is, it shouldn’t matter anyway.

There are angels who look for early early deals, try to find $5M to 20M valuations. Those valuations aren’t going down.

But still, you should reassess, check your priorities, tighten things up.

1. What are people doing now because your product doesn’t exist, what is the pain you will solve?

2. What is it that you know about your specific niche that other companies do not?

3. How and when does this make revenue and profits? What is the growth graph?

@tomnora

by tomnora | Apr 6, 2015 | Angel Investor, startup CEO

By most measures, we are in crazy times right now in the tech startup world. We have thousands of new companies every week, hundreds of funding rounds over $100 million every month, and so many $1 billion exits or calculations that we’re getting used to them. A $1 billion valuation used to be a big deal for a web based company that wasn’t one of the top few.

Everyone thought Facebook was nuts when they walked away from such a deal. But now the funding seems to be flowing everywhere, at many levels, and that almost anyone who starts a startup will be successful, will be “big”. Unfortunately, this is very far from the actual truth; we just don’t hear about the 95% that fail and lose all of whatever money is invested.

The frenzy at these higher levels, and the continuous stories of first time entrepreneurs in their early 20s who magically start these amazing companies is creating a demand at the bottom of the funding market, like the pyramid schemes in Southern California in 980 (see below). Look out for this trend, put your wallet away.

Unsophisticated investors, which means family, friends, co-workers, etc. or also called triple-F – friends, family and fools, who have a few thousand dollars they would like to put into the startup “market” are the fuel at the bottom of the market that get things started. It can be anywhere from $5,000 up to $500,000. They help to make ideas into reality, hoping for the higher returns of the early investors. You’ll see many dentists, doctors, parents, Hollywood actors in the crowd. They have a lower probability of return, as expected, but now are losing their money at higher rates than ever before. We don’t hear about this much because they’re embarrassed; who wants to talk about it and admit that they made such a mistake?

This market is reminiscent of the rampant pyramid schemes in the 1970s. Here’s a description from Time Magazine June 16, 1980 issue:

For $1,000 each, 32 newcomers buy slots on the bottom row of a pyramid-shaped roster. Each new player pays half of his $1,000 to the person at the pinnacle, who ends up with $16,000. The new player also pays his remaining $500 to the person directly above him on the next tier, which contains 16 people. Since each person on that tier gets paid by two of the newcomers, he ends up with $1,000, thus recouping his original investment. As more people buy in, the players move up the chart. In time, theoretically, each person reaches the top—and $16,000.

Amazing, huh? The only problem was that the need for newcomers increases exponentially, thus the name pyramid. You needed 32 new people every night, and as the word spread new groups popped up everywhere in L.A. It fizzled out within a couple of weeks, but went on for years in other parts of the country.

Skip to 2013…

Two years ago in the California startup world there was a lot of buzz, or anti-buzz, about the impending pop of the current hyperactive tech market and unsophisticated spending of . The concerns took many forms, one of which was named “Series A Crunch”, another was the gratuitous use of the word “bubble”. Series A is the second round, the one after the seed or other small amount of ignition money. It’s the round that graduates of accelerators seek. It’s also “professional money”, not triple-f.

I remember being asked in a startup panel I was on by the moderator “What do you think of the Series A crunch?”. I replied, “Do you know what a Series A Crunch is?” She tried to explain but didn’t in fact know what it was. That was a sign to me of startup overhype, everybody mimicking each others phrase of the week.

Fast forward to today, 2015, when we’ve been in a possible “end of the boom” for over 3 years. We’ve been hearing the word bubble for that long, people trying to predict a crash, mostly out of envy for not being able to harvest any cash from this current crazy market. Seed funding is at an all time high rate and it has that scary phenomenon of feeding on itself.

There are a number of articles floating around again about the lack of Series A money in the market, which is usually required to take a company to ROI.

At the same time people are bragging about how easy it is to raise seed funding of up to $1 million. Almost anyone with a web based working “app” or mobile app can get funding. No business plan, no ROI. Sometimes you’ll need to show traffic/traction/conversion, but not usually. There are plenty of triple-F investors anxious to empty their 401K or add another mortgage, take a “risk”, for the chance at those 8 to 9 figure exits they keep hearing about.

This is also reminiscent of the late 90s when unsophisticated investors lost billions diving into the dot com boom just before it crashed fairly rapidly. The difference is now it’s not crashing so visibly. There are admittedly many more successful growth startups on the Internet than ever, the second renaissance of the web, but the statistics for success are much worse than ever.

If you look at CrunchBase, almost every day you’ll see a new funding of over $100 million. Almost every day. That’s enticing to a potential angel. You’ll also see several others from $10 to 50 million. This has become the holy grail for that 401K earning slow interest.

But here’s the problem. Most of these investments will return $0. Not 80% or 50%, zero. In this flurry of amazing new Internet startups, a higher percentage are failing after the seed round than ever before, probably close to 99% vs about 85% 20 years ago. That means almost every unsophisticated angel investor is losing their savings and adding new debt to their life.

Why will so many people lose their money and why is no one talking about it? Here are the reasons:

- It’s very easy now “look real”, i.e to create and deploy an Internet and/or mobile app live on the web or a phone. I get pitched one every day.

- We’re still in a terrible job market, no matter what the official statistics say. I’ve met more broke unemployed professionals in Beverly Hills and Santa Monica in the past 3 years than ever in my life. They have nothing to lose. Why not start company.

- The Triple F effect. Friends, Families and Fools. Those are the people who will give you funding based on no actual research or due diligence.

- Erosion of true self analysis. One very critical part of succeeding in a business is being able to critique yourself as a business. As part of the new startup world people are avoiding this process. It’s become a casualty of “fail fast” and pivot and other buzzwords.

The bottom line is that people with no experience or particular expertise in almost anything will most likely fail. So get some expertise involved before you go get that wire transfer of $100,00 for the son or friend or co-worker you want to help.

t [at] tomnora dot com

by tomnora | Oct 26, 2014 | Angel Investor, early stage, founder, Hawaii, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

How is it that so many people associated with startups reap the financial benefits, yet others just as close get no financial upside This is a source of frustration among many people in the startup sphere. Imagine if you’re in Silicon Valley right now with no equity in a tech startup, but associated with several people getting six figure “bonuses” because they somehow wound up with some stock in one.

The free parties (or not free) and swag and great stories and boat rides in the bay are nice. Sometimes you’ll even score an iPad or Apple TV, but it’s not the same as being one of the insiders.

Often as startups grow and maneuver their way through the jungle of success or failure, they have a lot of help from those around them.

Often many these people don’t have any equity or upside from their advise or moral support or money lending, or even the spare couch they let you sleep on when you were in their town.

If the startup actually makes it to an IPO, there is actually something you can do.

It’s called the “Greenshoe”. You have to be very careful about this, you can’t imply or promise anything in advance, and it only works when the company goes public, but the Greenshoe is an amazing award for those involved that don’t have equity.

The Greenshoe is an over-allotment of stock options, up to 15% of the total offering at time of IPO. You can offer these options to virtually anyone, friends, family, people who helped your company. Since they’re options, acquirers only exercise if the stock goes up, and have no downside risk or capital outlay.

Upon the IPO event, the option owner can gain the upside if the stock goes up over the initial offering price and essentially collect that difference.

I’ve used it a few times when I was lucky enough to be able to offer it to friends and family. Strangely enough, some people have declined, because they’re not sure it’s legal; they’ve never heard of it. Others have bought themselves a new Lexus with it.

Here’s more info on wikipedia:

Greenshoe

The Greenshoe should provide motivation for all of us in the startup world to try to continuously build our company steadily, continuously and profitably and to know that you can make many peoples lives a little bit better by sharing the wealth. The rewards are pretty amazing.

Contact me at

#Web #Development #Digital #Strategy #Art| tomnora.com

by tomnora | Sep 15, 2014 | AdTech, startup CEO

As many of you know, I’ve been a big fan of the company Nasty Gal for a lot of reasons:

- an L.A. story

- Outsider non-techy female makes good

- They’re Profitable!!

- They have (had?) the chance to help define the next gen of startups

However, they seem to be in the predicament that many successful startups fall into. They may not want to be called a start up, but they are, because they never made it past PHASE 1 successfully into PHASE 2…

see Nasty Gal Lays Off Up To 10 Percent Of Its Workforce

- PHASE 1 – Amazing idea or business model, luck, funding, hyper-growth, parties, t-shirts

- PHASE 2 – Long term business success, sustainable, agile, adaptable business model, ability to survive major downturns, extremely happy employees.

Nasty Gal did many things right, I won’t list them all here. But they also failed in many ways already, and I won’t list all those here (I get paid to do that). I’ll sum it up with one word – Arrogance. I understand their feeling of invincibility; I’ve been there. What the arrogance did was cause them to not open their minds to the experts, not know how to let go of credit for success, not know whom to trust. I know this because I know several trustworthy experts who offered to help Nasty Gal repeatedly over the past 3 years, all rebuffed without even a response in most cases.

Nasty Gal didn’t realize the game gets tougher as time goes on and revenue goes up, unless you’re part of the Silicon Valley/Stanford/San Francisco in crowd, which they’re not. Marc Andreesen ain’t gonna save them, unless he can take over control and put a professional team in there. Continuous steady growth is one of the hardest things to achieve in business. It’s complex, chess not checkers.

Nasty Gal didn’t try hard enough to expand their popularity beyond the “cool people” that got them to $200 million, and they spent too much money on other things. Expanding and reforming your audiences is critical in continuing growth. Look at Facebook, Apple Amazon and others who successfully survived and grew for over a decade – they look much different than they once did.

So now what?

One of the things that can save a company when it goes into a bit of a tailspin is to lean on your employees loyalty to their management and love for your brand, because they’ve been treated well and respected as equal human beings no matter what their title is. The importance of this can’t be underestimated, as your employees tell everyone they know either good things or bad things about their employer. It looks like Nasty Gal will have trouble with that also. If you believe their glassdoor scores and reviews and “word on the street” in L.A., they are on their way back down the bell curve.

The bottom line value for any company is their list of intrinsic value assets. For an e-commerce company selling trendy clothes online, assets have to come from many things other than the products, mostly from PEOPLE and the way they feel about the company and brand – employees, partners, consultants, vendors – but especially your lowest level employees. Don’t make your employees resent you, make them feel like your success is their success.

@tomnora

by tomnora | Aug 6, 2014 | Business Development, CEO Succession, early stage, founder, Revenue Growth, Scalability, startup, Tom Nora, venture

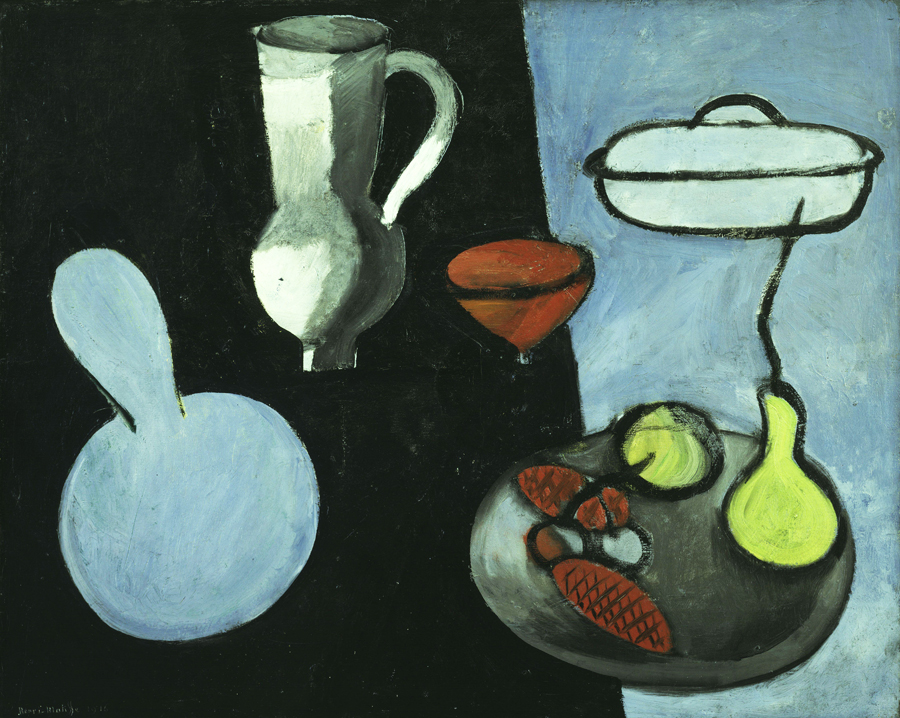

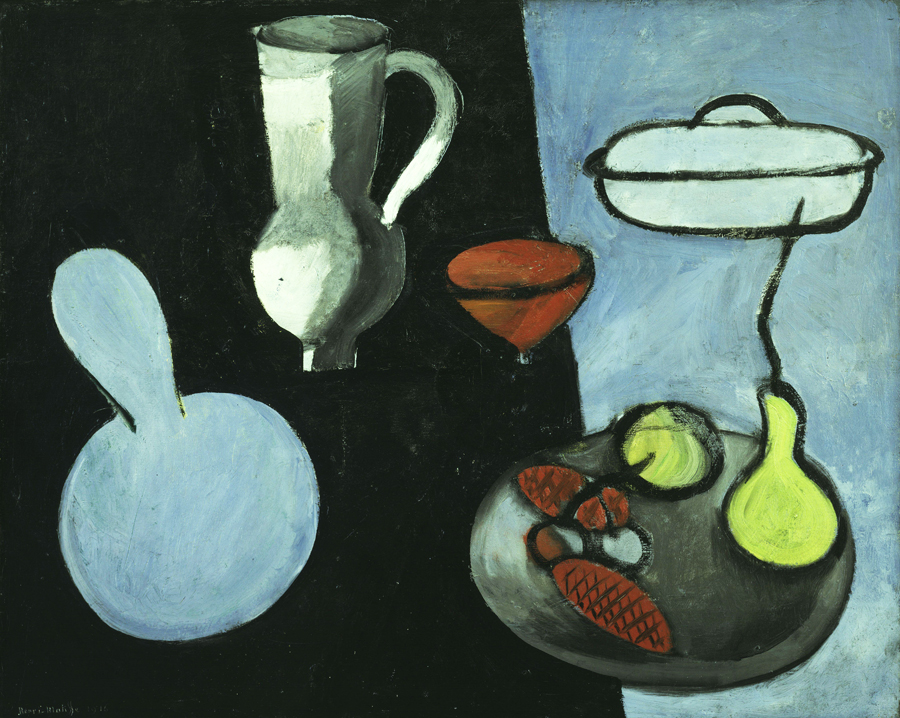

“Creativity takes courage.” –Henri Matisse

This is one of my favorite quotes about innovation, by an innovator who is still revered 100 years later; it’s the first thing you’ll see if you go to my personal website http://tomnora.com/ . Matisse was an amazing innovator, and his innovation and originality

Innovation, Originality, Creativity – why are these things so important in the tech startup world? And what do they have to do with art or painting?

I have the opportunity to visit many secondary and tertiary startup markets in my travels, meaning not Silicon Valley or New York, and one of the things that always strikes me is the lack of originality in almost every company pitch I see or hear.

I can see that the entrepreneurs I meet are sincere, have usually put a ton of work and pride ion their invention or product. Often they have put a fair amount of personal or family capital into the venture (these days that’s usually their parents money).

The major flaws in their planning process are denial and ego fortification – they don’t do enough homework to see how many are already doing something similar because they don’t really want to know; and they highly overrate themselves as amazing entrepreneurs. This is a bad combination for success, but I see it daily.

I get it; I know it’s more difficult than ever to build a real career and easier than ever to start a company. But the very core of creating an interesting and new business should be the concept of originality. Some originality, enough to be different, unique, without being too weird.

Real originality comes from within, because it is inspired, comes from adrenaline and emotion, not from a spreadsheet or desire to merely make money. Finding the mid point between originality and capitalism is what I define as business innovation.

There’s nothing new under the sun, so you must critically modify, hack, or turn sideways existing systems with a truly new vision. Instead of just copying or slightly modifying something you see, try to take it a few steps further.

One of the quite innovative methods Matisse and his peers used was finding inspiration from other skills they already knew, leveraging their expertise as craftsmen. Matisse was a draftsman, a printmaker and a sculptor, and you can see these influences in his paintings.

Part of the magic of great business innovations is knowing which rules to break. Matisse broke some of the rules, but kept many intact. The rules about the way business processes flow are too often just accepted, but if you can analyze them, find an achilles heel, then innovate a better answer. Get rid of the obsolete rules without breaking the good ones, and great things will happen. It’s about where to hack and where not to.

I went to a pitch fest in one of those secondary markets the other day. Most of the presentations were weak delivery, boring, been done before and uninspiring. But there was one that was pretty amazing, by an 18 year old who had become deaf at 12. He has developed an exercise system for handicapped people; you tell by his excitement and thought process that he was inspired, and created true innovation. He wasn’t polluted by how corporations work or the rules of business – he was still in high school.

Another Matisse quote is “There are always flowers for those who want to see them.” Look carefully, take the extra time and find the uniqueness in any idea you want to realize – it’s there. Find me on twitter at @tomnora