by tomnora | Feb 9, 2011 | founder, Revenue Growth, venture

First revenue are a major validation milestone for a startup after much sweat and tears. You’ve gone through initial idea, sat at coffee shops or peoples houses brainstorming, discussed and executed the company formation, started building a product, are going through your launch, interacting with first users and maybe even have gotten some press, but none of that compares to people paying for something you’ve created from nothing. It also is the first “organic” fuel for the building process for your company.

Recent developments in web business models have made this hurdle much lower. For example Googles AdSense, Facebooks virtual economy, micro-payments and wide use of the Freemium web model. But it’s still quite a nice feeling to see revenues coming into your enterprise, and makes you want to figure out how to build upon it.

Revenue can change many things for you and your company – valuation, respect, confidence, negotiating position, attraction of other revenue and cash, retention of your equity, and the ability to attract key people and partners. If the revenue is significant, as in a major partnership that pays six figures or more, it can set in motion the next phase of your strategic planning.

Preparation, a Chief Revenue Officer

Also, you must be tactically ready for this step before it happens – know exactly how you want to accept revenue, prepare all required forms, build template legal agreements that may be required, seek help from experts where needed, have your banking in order.

But how to get these first revenues? Aside from the low hurdle examples above, there are many other ways. These days almost everything involves the web and automation, but there is an all important factor – human to human contact. Call it sales or marketing or bus dev, but the important piece is dedicating yourself to spending some time face to face with those you hope will be your highest consistent paying customers. Not “unpaying” users or beta testers, but strategic customers, partners, influencers, those who will take you to your first levels of success beyond investors. This is how you “get it going”, how you start the revenue ramp upwards.

For many startups this face-to-face part of revenue development is where they spend the least amount of their time, for hundreds of reasons, but mostly because they aren’t comfortable with this part of the process. If you can overcome that issue, you’ve overcome a major hurdle to growing revenues. The impact of hearing live from another human about your product is immeasurable, proven over generations of business.

One way to vastly increase your company face-to-face hours per week is to early on have a dedicated partner/co-founder who does only this – “Chief Revenue Officer” – talks to people, gets out there, constantly hunts for new money for the company and articulates the vision. In the beginning the rainmaker is usually the founder/de-facto CEO, but not always. Some startups bring in someone pre-revenue to take responsibility solely for getting the first revenues. I’ve actually been that person at a few startups; it’s a great job for the right person, whether you call it sales, business development or even CEO. The key is getting the right person/people, indoctrinate and empower. And get that first revenue.

by tomnora | Feb 1, 2011 | founder, startup CEO

The last blog entry I wrote [Who’s the Boss? What is a CEO?] made me think about overall business decisiveness and it’s critical role in growing a startup properly. There are many synonyms and attributes of decisiveness – certainty, determination, finality, resolve, authority. But there’s no single formula or magic combination for this quality.

Decisiveness is one of the key skills for the leader of a startup to succeed; not everyone involved, but definitely the leader/CEO. It’s fine if you’re not that type, just be honest about it and find someone to take role. An indecisive leader will get run over by the crowd quickly and lose the respect of those around him/her; better to let someone else run the show and focus on another task.

A strong CEO in an active startup should be making and implementing several decisions every day. The job of CEO of a real operating company includes many lonely times, no matter how many people surround you. But no matter what, the bullseye in on your head.

For most strong leaders decisiveness is an innate quality, a feeling of empowerment and confidence that comes from somewhere within as well as the support of those around you. Some people are just born with it, or into it. A great example is Sophia Amoruso.

You thrive on the pressure of making decisions. Inspiration comes from beating obstacles in your past, overcoming a hardship or two, intense desire to succeed, past (or current) poverty, or some other experience in life where correct decision making took you from bad to good. Also, a startup CEO is usually much more decisive in his/her 2nd or 3rd startup than the first. They’ve “been there before”, understand the forks in the road, have been hardened and/or humbled a little by mistakes.

Lack of decisiveness at the top impedes growth. Lack of decisiveness running a startup usually is related to lack of experience, a different personality, or lack of desire to be that person. Can decisiveness be developed or taught? I think so. Self-confidence?

Probably not so easily acquired. I was quite lucky early in my career to have several great role models (and a few bad ones). Examples and proactive mentoring came from several places for me, some quite early in my career. I’m now trying to give back by advising others and mentoring startups.

So be decisive as the overall leader of your startup and surround yourself with support to make better decisions. Find mentors, delegate, let go of details. Or be honest with yourself if this isn’t you and find find someone qualified whom you trust to take that role and let them run with it.

Your startup will be the winner.

Find me on Twitter.

by tomnora | Jan 27, 2011 | Revenue Growth, Scalability, venture

REPOSTED 2013

:: An ominous title for a blog post, but “Grow or Die” has been one of the most basic rules in the high-growth startup world for decades. And by growth I mean revenue growth.

The first trick is to offer something that the world will need more and more over the next few years (growing market), without that it doesn’t matter much anyway; your product/service/thing must “catch on”. This can be somewhat manipulated by your successful marketing execution (i.e. why one iPhone app succeeds vs. another).

If you do have something compelling, you’re either running as fast as you can to catch up to something bigger or to stay ahead of those below you. Lack of growth will encourage others to come along and knock you off the track, attack you; they will smell blood. Inconsistency in growth can do the same thing. Millions are currently watching boastful high flyers like Zynga, Google, and Facebook to see if they stumble. If you’re not offering something in a growth market, it doesn’t matter so much; you become either a zombie/lifestyle company or shrink slowly then die.

If you’ve got something hot, the idea is to spread your footprint quickly and prevent others from knocking you off (first mover). Growth means bigger and more complex barriers to entry – more advertising, products, support and security for your users/buyers, advanced services, etc. And protection form death. And gasoline to create more growth.

Flat to negative revenue growth is a real red flag, especially for early stage companies. Your stakeholders start to wonder what is going wrong? Did we build the wrong product? Are we becoming passé? Time for a new CEO? And all those other depressing clichés. If you’re venture funded, things get kind of ugly -unhappy board members, cut off from communications, down- rounds to keep you going, or no more funding.

Many early stage founders aren’t sure how to handle this requirement for success. What about users? Eyeballs? Hits? Press Mentions? Those are all nice and should be designed impact revenues, but usually aren’t a real measurement (unless you’re Twitter). Revenue growth must be the core strategy and drive all other strategies.

Continued growth becomes more and more difficult for larger companies, you must “feed the monster” as it grows. Many companies are currently hitting the wall after strong growth, like MySpace, Yahoo, Dell, Fedex. Even Google is starting to struggle due to a slowing growth rate, and attracting attention for this problem – losing employees to Facebook, trying across the board 10% raises, switching out their CEO of 10 years.

But the focus here is not big companies, it’s startups in their first years of revenue. Companies that hit their “first millions” then get stuck, and often panic. I was once VP of Sales for a startup that went from zero to >$10 million in one year, then back to zero the following year. Talk about panic! That’s an extremely contracted timeline for up then down the growth curve, but the general trend is not that unusual in startup land – up then down quickly. In our case we didn’t have our internal house in order, and didn’t know how to handle our sudden success – no strategic planning and thereby no adherence to such a plan.

The bottom line is that continuous growth, at a good rate, is imperative for long term scalability. If this is a hole in your business strategy, don’t ignore it. Put your heads together, hire expertise, call your advisors, revisit your business models, sacrifice sacred cows, and respect this key piece of your success.

But make sure you deal with it.

![THE “WEEKEND” STARTUP – – – SCALABLE?]()

by tomnora | Jan 19, 2011 | early stage, Scalability

There’s a recent phenomenon in the startup world, the quickly built startup, where as few as 1 or 2 engineers can hatch an idea in code and deploy a new web-based company within a few days or weeks. Also known as startup-lite, startup-in-a-box, the 90 day startup, hackathon, etc., the proliferation of these quick startups are the result of many converging milestones in high-techdom – advanced simplicity in web design, “little or no-programming” visual technologies, extremely low cost of entry, an explosion of micro-funding and some shining examples of dream-come-true companies/people like Facebook/Mark Zuckerberg.

Groups like Techstars, Y-Combinator and several others are fostering this trend with “summer camp” like gatherings to help young entrepreneurs get a new company up and running, with a team of world-class mentors, paid lodging and often funding, in less than 3 months. Techstars alone graduates 30-40 companies per year in 4 different cities. What a concept!

The advantages of this trend are obvious – democratization of the process (anybody can do it), low barriers to entry, minimal overhead (a laptop and free dev tools), almost instant revenues, easy leverage of the social graph for push-button marketing. This new bridge between the haves and have-nots, or techs and tech-nots is inspiring many to start their own web/app companies as never before. Any undergrad at Stanford or Harvard or any other college must be constantly thinking about this – “What company am I going to start?”. There are countless people in their early 20s these days that are on their 3rd or 4th startup already. Mark Zuckerberg was on hs 4th (Synapse, Wirehog, Facemash) at 19 when he started Facebook.

So it’s clearly easier to build and easier to discard one that doesn’t take off and move on to the next. And the next. Amid all this excitement, what is the long-term track record of these mini-companies? How many survive after 12 months? 24 months? How many never achieve revenue at all? There is a naturally high failure rate in startups that we know about, ~90%, so is this new generation more or less likely to make it long term? There are no proper records for the many unknown startups that never make out of the bedroom or off the living room couch, but the throw away rate is probably very high. Techstars actually keeps statistics of its graduates on its website – alive after 12 months, 24 months, funding, acquisitions <$2 million and >$2 miilion, etc. But remember, Techstars rejects over 500 companies every year. How are those accounted for?

Does it matter? Maybe not, this is almost more experimentation, practice than pass or fail – Zuckerberg still holds all night hacking sessions at Facebook to stay sharp and connected to the keyboard, to promote discovery. There are hackathons, hacker spaces and other informal Internet company formation vehicles everywhere you look. The world has clearly changed.

But back to Scalability… are these entities scalable over time? In most cases, probably not.

Let’s measure the Idea plus the Implementation:

- The more amazing and unique the idea, the more likely it will grow into a sustainable company. Most quick-Internet company ideas don’t have much longevity.

- The faster (i.e. very few engineering hours) something is put together, the lower its barriers to entry for others to knock it off.

- The personal investment and passion are typically much less in a quickly built site.

There are exceptions to these rules of course (twitter), but generally it takes a lot of work to design, build, implement, adapt and polish something into a must-have application for the masses.

An Exception to these rules

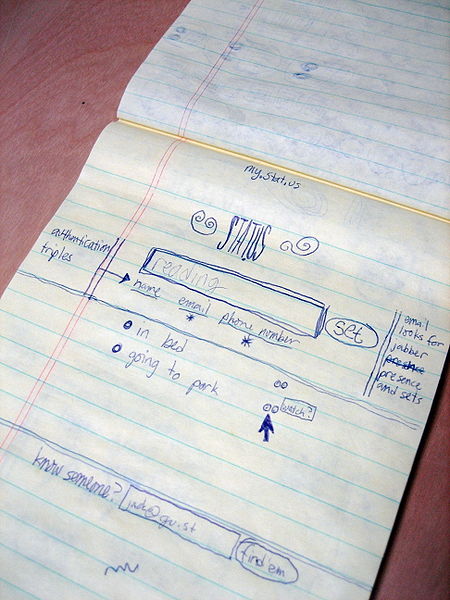

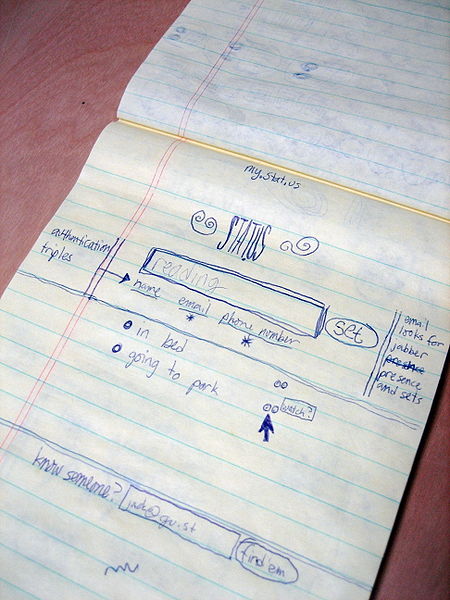

A great example of an exception to this rule is Twitter. The first Twitter (Odeo) interface was by design extremely simple, and drawn on a piece of paper by Jack Dorsey:

And the rest is history. It turned out to be an extra-amazing idea that grew enough as a name brand before it could be knocked off. Although some people still aren’t sure what to do with it, Twitter is clearly now a must-have for 100s of millions, myself included. A fairly simple idea, quick to implement (it took 3 months). But an amazing addition to our world.

by tomnora | Jan 11, 2011 | Scalability, startup CEO

When tech entrepreneurs hear the term “scalability”, they get excited, and rightly so.

Scalability is a worthy subject, arguably the most important parameter in startup success, especially long term. Controlled growth is the primary ingredient for survival in the highly competitive startup world. But what exactly is “growth”?

Is it measured by quarterly revenue? Eyeballs/Users? Buzz? For early stage companies, it is mostly revenue, especially if the company is pre-revenue. Revenue is the fuel that propels the company, allows hiring of great people, decreases dependence on investors and thereby preserves equity for founders and employees.

For most startups, first revenues and continuing revenues seem like magical milestones; before they are reached there is no sure way to know if/when it will happen. I know, I’ve been a pre-revenue CEO many times.

But there is much more to scalability than revenue. Revenue injections are like oxygen, and strong measures and reassurances that your company is real, and that you have a chance to become a long term enterprise.

The resulting cash flow, cash on hand, and recurring revenues give a warm fuzzy feeling like no other. But revenue alone doesn’t ensure scalability. Many other factors are critical in building the right foundation to construct a strong, integrated enterprise down the road.

This blog will hopefully explore many of those other factors, and help early stage management teams to make the right decisions as they create or encounter and then manage growth.