by tomnora | Jun 21, 2019 | founder

This article is a quick note to answer the many inquiries I get about finding the perfect cofounder.

Over the past few weeks I’ve been casually looking for someone to work with, to develop and market a suite of mobile applications (iOS, Android) for the entertainment world. I’m describing this other person variously as a cofounder, partner, CTO, and collaborator.

The focus has been on someone with the right combination of technical experience/excellence, mutual chemistry, plus the right timing and inclination in their lives to do this.

I’ve asked around, talked to friends and even put a little ad in craigslist in Los Angeles. Through all this there have been many responses, some very positive, and some pretty weird. I realized what I’m doing is inadvertently conducting a social experiment here.

The explosion of mobile phones and mobile apps has created an almost visceral response when you mention mobile, or Droid, or especially iPhone, or iPad. Everyone wants to have a connection with it, whip out their smartphone, show you their aquarium screen saver.

You either have one or wish you did. When I was a child, it was having the newest Schwinn bike, in a cool color. $37.95. Or the latest hot record album. You either had them or wished you did.

Now it’s another computer device that you can carry with you, is “always on”, and can do almost everything (and plays the latest hot album). Suddenly waiting in line somewhere you can instantly become productive if you want, or play a game.

If you carry this one step further – actually being involved in developing and deploying mobile apps, it’s even more compelling. A higher level way to become part of the society and possibly make some money.

COFOUNDER FOCUS

The focus should be more on the functionality or enjoyment or how you’re improving the world, but it’s not – it’s more the idea of being part of this new baby-app world. The result is many apps and businesses that come and go quickly.

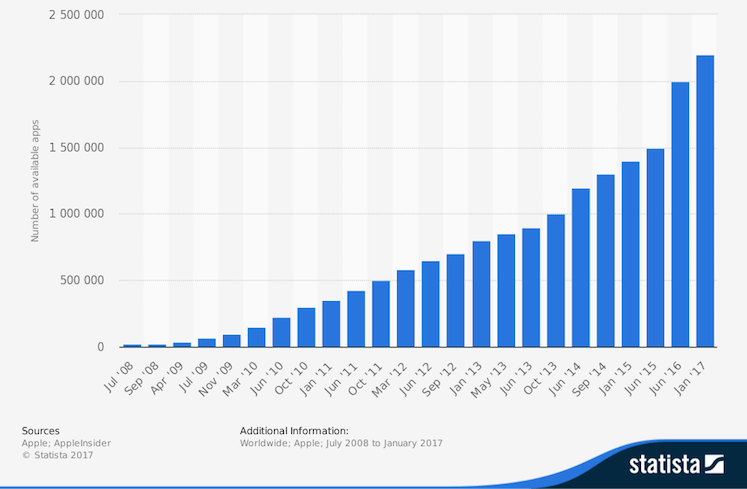

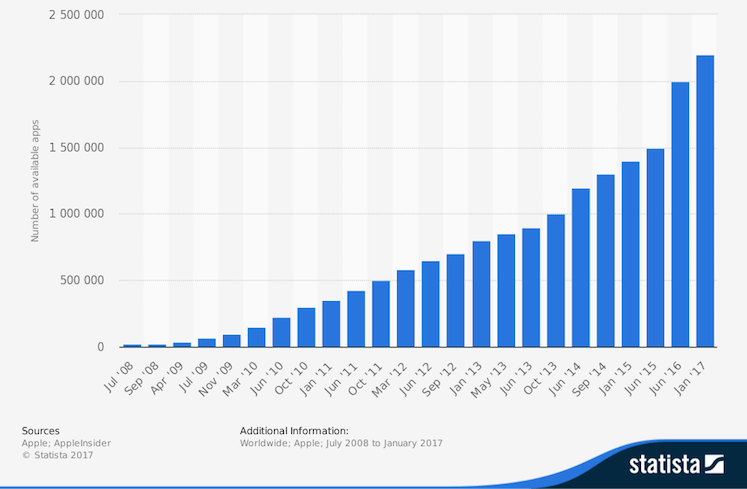

Over 2,200,000 iOS apps are deployed plus equal amounts of Android and others. Most are unused or have a short lifespan and very little revenue. It’s more of a hobby or personal challenge than a scalable business.

In looking for a co

founder, I’m searching for the combination that will allow us to build a long term growth company, scalable and adaptable over several years. I want to create long term jobs and products people will use. That’s not the sentiment of most CTO-types I talk to. They want Cash Now, to be paid for their work by the hour/project.

KEEP LOOKING

I see the economy has changed the focus to short term survival, not entrepreneurship (except in Silicon Valley). People believe they can learn app dev in 3-6 months and then create their own long term income, and they’re right on the mark in many cases.

Aside from revenue generation, mobile apps are needed for basic business existence in most areas. Almost all companies are retooling their public image while also increasing their ability to market real-time. The mobile phone/pad is becoming central to our lives, more than our computer in many cases.

I’m going to keep looking for a cofounder. I’ve been lucky enough to create a few new products in this world that stick, which creates the backbone of scalability, I’m having more fun in this new domains than ever before. If you know anyone, send them my way. @tomnora @cowlow

by tomnora | Dec 31, 2014 | AdTech, CEO Succession, photography, PHP, Scalability, startup, startup CEO, Tom Nora

Pinterest as we know it could be a thing of the past. Beginning January 1, 2015, Pinterest will start putting ads on its site. Real ads in the form of promoted pins. I have mixed feelings about this – I respect their right to do this and I’m happy for them to be able to get a piece of the enormous revenue stream that Google and Facebook dominate, but it will also take away the purity of Pinterest and lessen the experience a bit.

Overall, I say congratulations, you’ve earned it, Pinterest! They will now move up the food chain significantly as Fortune 500 companies can develop more formal relationships with them and build “serious” ad campaigns. All other ad industry professionals and component niches will also take a big step closer to Pinterest. This is like opening up a whole new giant beautiful piece of the web to advertisers.

But there is a cost to this for users. Pinterest is one of my favorite places to go on the Internet, one of my favorite apps. It’s an oasis in the ad strewn desert of social media. There are many indirect ads there already, especially clothing sold by affiliates, but not very intrusive to the experience.

Pinterest is a constant river of pictures, and mostly very high quality pictures, undistracted by ad text or flashing lights. It’s a respite from the rest of the web, with its rectangular boxes of advertising or the sidebar of Google ads – the high value real estate of the web that is rented to the highest bidder.

As a major fan of photography and imagery I like to go over to Pinterest to get away from all that. It’s almost like a relaxation lounge on the web. I’ve slowly built and curated my collection of pins over the past 3 years, with a bit of an eye towards social validation, but mostly to see cool photos. I’ve been pleasantly surprised thousands of times by images I’ve seen. How many products can claim that?

One of the best parts of Pinterest is that it’s participatory, a gamification of looking at photos (and memes and infographics). As you browse build and organize your collection and it shows running totals of several statistics. And there’s minimal social interaction, almost like a library where people tend to be quiet and leave each other alone. A relaxing experience. I even have a board called zen relaxation that I can go to for quiet inspiration.

Pinterest no doubt developed one of the most fascinating products of the last decade, almost as powerful as Google, facebook, and Twitter. It’s addictive, stimulating and makes you smile. Hopefully that won’t change but it could.

The best part of the product is its design. Pinterest pioneered a new type of web page, now referred by everyone as a “Pinterest style”. It’s hard to remember now, but 3 years ago it was revolutionary. That single innovation was more influential than almost anything prior on the web.

Pinterest will do this with a lot of style – use a native ad approach with the Promoted Pin, but it could change them if they’re not careful. They are playing with the big boys now. Giants corporations will have a more formal dedicated part of their ad budget and marketing team focused on Pinterest, like they do now with Google ads and Facebook. Giant corporations will want to “help” Pinterest figure out how to change. Giant corporations will want to acquire Pinterest. Let’s hope they keep their independence as long as possible.

Billions of dollars will be diverted from other ad channels to Pinterest. It could easily tarnish the brand. The fact that they have waited this long to monetize in this way and have built such great brand equity is quite encouraging.

It will also be a great opportunity for advertisers of all sizes, even the little guys. Buying real estate on Pinterest? Awesome!

No matter what happens, I’ll always be a big Pinterest supporter (is there a name for that? Pinterevist?) I hope they don’t hire a thousand lawyers or get acquired, but I trust them to handle this change with the same style they apply to everything.

@tomnora

![Silicon Valley Uber Alles? I think so… Some of their Secret Weapons.]()

by tomnora | Sep 11, 2013 | Angel Investor, Business Development, CEO Succession, Drupal, early stage, founder, Hawaii, Jobs, Launch, Revenue Growth, Scalability, startup, startup CEO, Tom Nora, venture

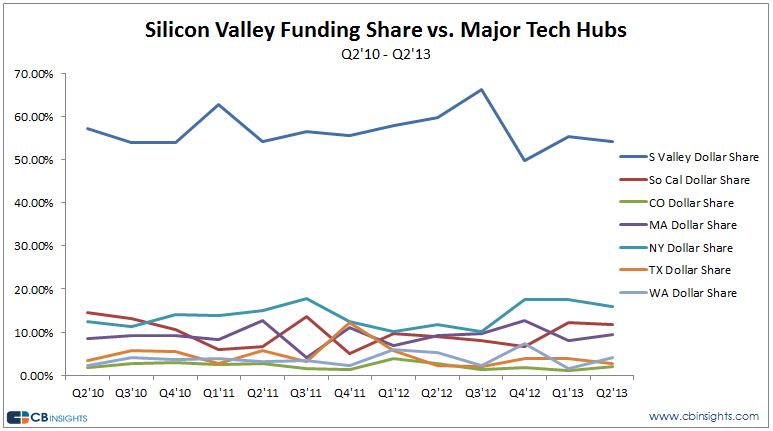

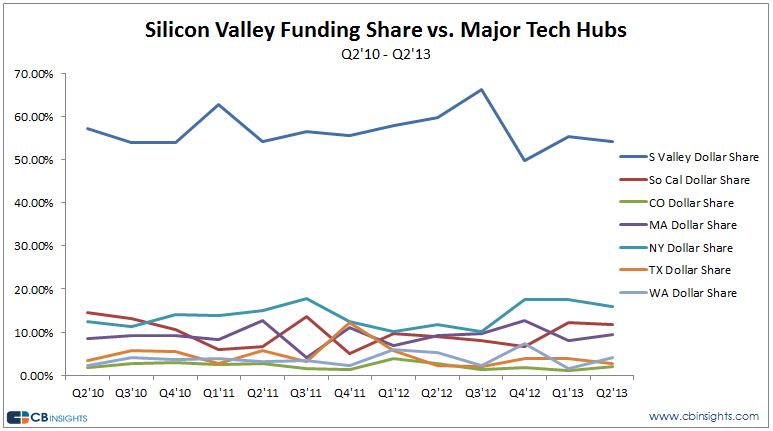

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form] Can any other region “catch up” to Silicon Valley, or be the next Silicon Valley? Statistics show that it’s probably kind of futile to even try. Many have tried, but must be content with their small market shares. How can other regions will ever match the MACHINE: Stanford, Andreesen, Draper, Valentine, Doerr, Facebook/Apple/Google Millionaires, 4 Generation VC firms, Hardware/Software partnerships, over 100 Billon $ market cap cos.

Because high tech and software industries are now being seen as lucrative, job creating, imperative and oh so sexy, many regions are trying as never before to get in on this – mobilizing their governments, old school industries, universities and grandmas to unite to be the next Silicon Valley, calling themselves Silicon- Beach, Forest, Plains, Alley, Prairie, Coast, etc. These towns are setting their expectations way too high while the real Silicon Valley giggles at the sight.

Here are some of the secret weapons that make Silicon Valley stronger than any other “region” and act as its barriers to entry:

1. Silicon – Uh, yeah, that word? It’s what started all this. Silicon Valley launched and was launched by the mainstreaming of the Silicon chip over 50 years ago, which is now part of everything. There was no other part of the planet where anything close in innovation, design manufacturing, equipment, marketing and sale of semiconductors has emanated from. This foundation still drives the area and the world, even thought it gets less attention now than the software side.

2. 100 Years of Growth – It all began with military electronics, low cost housing, lots of empty land and Stanford University. It has spread way beyond to the east bay. San Francisco, over 50 universities and trillions of dollars in revenue. The growth has had bumps but over time has increased more steadily than any other economy in history.

3. Recruitment – Most of the leaders in SV are from elsewhere because Silicon Valley aggressively acquires the best from all over the world. Why not? Via Stanford, Berkeley, Facebook, Google, recruiting Harvard and MIT undergrads, their wonderful PR machine, advertising free meals, free car washes, free dry cleaning, free day care. $150,000 salary right out of college. Unlimited vacation. Where else can you gat all this?

4. Stanford – Not sure this even needs explaining, but Stanford has been a wole new entity in the past 20 years, beyond anyones imagination in wealth creation, funding, computer science, a recruiting engine into SV then on to local companies, pride, confidence, location.

5. Money, money, money – There are so many giant sources of money in SV that it’s staggering. VCs of course, Angels, they invented the term Super Angel, San Francisco, Real Estate leverage, IPO millionaires, corporate funding, Asian and European money, and on and on.

6. Tolerance for Weak Links – Here’s one most people don’t know – most people in SV aren’t stellar; I know several weak players who fake it well and are millionaires or millionaires-to-be just because they’re in the right zip code. The public tagline is everybody has a high IQ, but in reality there are lots of dwebes running around – I know, I’ve managed plenty of them. SVs leaders smartly realize the win ratio can be pretty low if you have a few enormous winners. Most SV projects die, most SV companies die, but if you build the algorithm to plan for this you’ll put more possible winners in play. So what if a few totally unqualified employees that snuck in make a few million. Like any organization, there are several who skate by or get by on good politics. That’s OK if you plan for it, “engineer” for it.

That’s just 6, there are plenty more reasons why there will only be 1 Silicon Valley for along time to come. The best answer for any other local economy is to just make the most of who you are, embrace your own identity, partner with Silicon Valley. And don’t use the word “silicon” in your name. Take Boulder, Colorado as a model, they’ve successfully created their own very strong economy for startups. There’s a startup for every 50 or so people there. They have all the pieces and they are heavily connected to Silicon Valley without envying them.

@tomnora

by tomnora | Jan 19, 2013 | Angel Investor, Business Development, CEO Succession, early stage, founder, Hawaii, Revenue Growth, Scalability, startup, startup CEO, venture

Most startup entrepreneurs focus on one thing throughout the lifecycle of their company: bringing in CASH. C-A-S-H. Cash through investments, revenues, borrowing from F&F, VCs, convertible notes, deal terms, angels, etc. All of these things are magical words to early stagers. I attend and host many meetups and conferences for startups, and consult to several startups, and every founder is inevitably talking about Cash. Cash on Hand, The next Round, we just need $XXX,XXX. Cash, Cash, Cash.

A different way to improve your cash situation is the indirect one – reduce Friction Costs in your ecosystem with peripheral influencers.

In Silicon Valley, Boston, Boulder and a few other places, the growth of the startup world has vastly been enhanced over the past 10 to 30 years by professionals who are not VCs or developers or entrepreneurs – they’re the Accountants, Attorneys, Consultants, Professors, Marketing firms and others who have tremendous influence over VCs, Angels and prospective customers. They are trusted, fairly impartial, focused, big picture and practical. They’re also critical to the processes of business.

If you want to make money rain from the sky, nurture these people with sincerity over long periods of time, not just when you need them. They decrease the friction in doing business by connecting the right people, finding the quickest path between 2 points, making warm vs. cold introductions and telling entrepreneurs when “it ain’t gonna happen”.

So find some of these people and get to know them – here are 10 things you can do:

1. buy them a cup of coffee

2. be real with them, when you don’t need anything.

3. Help them out with something they’re working on.

4. Read What Would Google Do? by Jeff Jarvis.

5. Join my meetup group; you’ll find many of them there and can connect no matter where you live: meetup.com/Startup-Workshops/

6. Invite them to speak at an event you’re hosting.

7. Contact me and I’ll help you find and meet the right people.

8. Create something very cool, nothing gets attention like that.

9. Be a connector. Connect 2 people without any self interest; I do this almost daily.

10. Become an authority on the flow of cash in startups, a very valuable skill.

Tom Nora

by tomnora | Dec 12, 2012 | Angel Investor, Business Development, CEO Succession, startup CEO, stereo, Tom Nora

INC 500 CEOs are paid much less than Fortune 500. Is this gap closing?

Infographic: Which CEOs Are More Social? | CEO.com.