by tomnora | Jul 27, 2011 | early stage, founder, Revenue Growth, Scalability, startup, startup CEO

Aurum Rex. Nummus Rex. Emptor Rex.

I.e. Cash Is King. An old sayings, but so true in the startup growth equation. Where does revenue fall here? Is it more or less important? What about Strategy? Revenue? Growth? Buzz? Profit? A “Right On” product?. Smart People? Ambition? Your position on the Bell Curve?

When a startup has none, cash seems like liquid gold that can flow over the business and cure all – salaries, resources, exposure, growth, success, new offices, marketing. But often entrepreneurs fool themselves into thinking that lack of cash is their only problem. I’ve been involved or almost involved in so many early stage companies that said “If only we had $XXX in cash, everything would be o.k. Sometimes they get the new cash but still can’t scale or survive. Cash is certainly required to play, but it has to be part of a larger system, purpose, goal.

Venture capitalists, controllers of cash, are always looking for mind blowing new things that can “change the world”; can step out in front of our regular world and catch fire, anticipate what the world needs that no one else has figured out yet. And they have cash, high risk cash, to take a shot at being part of these new phenomenons. They get in early and guess at the future, which means they could be often wrong. But that’s not a problem; they only have to be right once in a great while to win big. That’s the game they’re in. What an exciting job!

On the other side we have the yet-to-be-funded or need-more-funding startup. Whatever cash is in this company is less than enough to spark it to the next level quickly enough to meet the business goals, or often just to make the next few payrolls. Is this you?

So what about REVENUE? Revenue is close to cash in it’s power within a startup. It can solve so many problems, including cash issues. It attracts more cash investment, it creates profits, it legitimizes your business. Revenue has to be managed properly and leveraged wherever possible, but those are good problems to have. It’s eventually more important than cash, especially when it’s steadily and predictably growing. Growing revenues, not cash, create higher valuations.

Early on, most startups focus more on adoption, eyeballs, users, traffic, assuming these will infer and convert to future revenue (Twitter, Google, Zynga, Facebook). The actual cash on hand and/or revenues don’t fully support the business, but no problem if major growth is apparent.

So is that it? User adoption? For Twitter it is, they’re currently at a valuation of 40X revenues, way high. But there’s no question that they’re permeating the globe, possibly with more longevity than Facebook.

The bottom line is value. What value, how many valuable things is your company providing. What’s better, cheaper, faster, unique, easier. Google is a great example of amazing and increasing value to user. It’s all of the above, mostly free, with an attitude of always wanting to provide more to its users while simultaneously simplifying use of everything digital.

Early on Google didn’t focus much on cash or revenue; they eschewed it, they had a higher goal – organize all the worlds information. Their goal and execution of it was most important to them. Of course they also happened to be a few blocks away from the highest concentration of venture capitalists on the planet, but they went 3 years without VC funding. Their first 2 years they had no revenues and received only $100K in funding, from Andy Bechtolsheim. A year later they raised $25 million. Their great ideas and excellent execution came before any cash.

So maybe cash shouldn’t be #1 for an ambitious startup, rather amazingness should, true passion, even if it’s nights and weekends around your day job.

@tomnora @cowlow @norasocial

by tomnora | Jul 19, 2011 | founder, Scalability

From July 2011,,.

California. Most of my 25 year career has been in California; about half of those in Silicon Valley. I’ve been involved with several amazing companies throughout Northern and Southern Cal; I have expanded, launched, M&A’d, relaunched, liquidated, succeeded and failed, you name it.

I’ve also had the good fortune to operate and sometimes live in several other fledgling tech corridors – Cambridge, NYC, Portland, Boulder, Santa Fe, Austin, Dallas, SLC, Frankfurt, Paris. In every case these other places aspire to be a self sustaining baby Silicon Valley of their own – Silicon Alley, Silicon Prairie, Silicon Coast. But they don’t quite make it. Some come close, like New York or now Boulder but it’s still not quite the same.

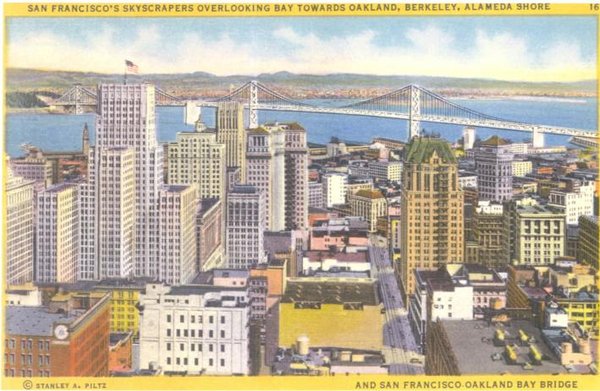

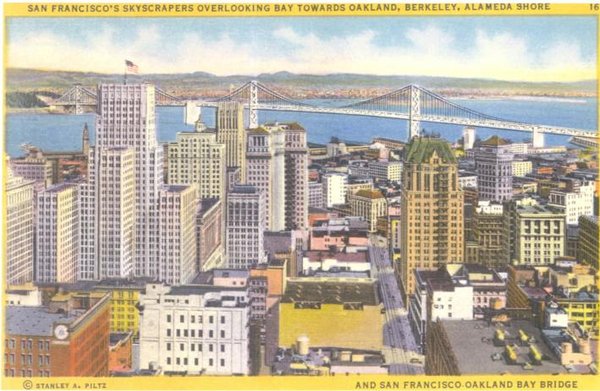

The term Silicon Valley is now a misnomer – it has moved way beyond silicon and way beyond the original Santa Clara valley to spread all over California. The new hot spots are San Francisco, Los Angeles, San Diego, the east bay, etc.

San Francisco

San Francisco has actually successfully co-opted the Silicon Valley magic and even surpassed it in some ways (Twitter, Salesforce.com); it’s again a very hot place to be right now and this will continue. Talk about scalability! If you plop your company here, great things could happen. It wasn’t always that way – in the 80’s and much of the 90’s San Fran was a sub-par runner up to SV, trying to catch up. Great PR and finance firms, but not many startups. Houses were cheaper, you couldn’t get good engineers, etc. That has all changed. Now companies have bidding wars for office space amid a major national recession.

There’s a magic and complex dynamic to the combination of things that make California so different. Just say the word and people take notice. There’s a seriousness, a buzz, confidence, reliability, completeness, professionalism. An assumption that you’ll more likely make it there.

Southern California

The “Silicon Basin” – – With the convergence of social media, the Internet, and digital entertainment, Southern California is now humming as a great startup region. In 2003 Electronic Arts actually moved their headquarters from Silicon Valley to Playa Vista, an crazy move at the time, and accelerated their growth as a result. Several smaller software groups, vfx studios and creative design labs are now benefitting from the movement south. Yahoo, Microsoft, Facebook, Google and others are growing their employee base and presence in L.A. Venture Capital from Northern and Southern Cal is flowing into the L.A. basin. It has the key catalyst – several excellent universities spitting out young engineers and business people. It has a strong and growing angel investor base, tapping one of the largest concentrations of individual wealth in the world.

There are exceptions to the California phenomenon; several amazing companies have emanated from these other areas, always have, and many of these ecosystems are now of course self sustaining, but they’re not the same as California. Countless companies have moved there for this advantage, reference Mark Zuckerberg/Facebook. Good move. If you’re somewhere else, it’s because you’ve made a tradeoff, a compromise. I know as I’ve done it myself several times and I’m glad I did. I’ve rooted for other places to approach California’s ecosystem, but I know they’ll never come close.

If you want maximum scalability for your business, you should be in California. If you the best capital providers, the best people, the highest valuations, you gotta be in Cali. You could get more advantages from a couple of visits to a coffee shop in Palo Alto than spending a year in some other town. @tomnora @cowlow

by tomnora | Jun 30, 2011 | CEO Succession, founder

The vast majority of early stage companies will companies replace the CEO in the first 2-3 years.

A person or group peers starts with an idea and turns a spark into a flame. Once that flame is s going they don’t want to let it die. They often conclude that a more seasoned, well connected, well rounded CEO will attract money, partners and revenues, taking the company to “The Next Level“.

All this will hopefully help the company grow in the right ways and produce cash flow. Cash allows small companies to fulfill growth and other objectives; cash generated organically helps do this without giving up ownership and control.

But t’s a bit more complicated. Introducing a new leader, whether internal or external, voluntarily or forced, s a delicate process. I’ve been the incoming CEO a few times, and found that acceptance happens quickly or usually not at all. Most startups have no experience doing this, are not prepared, and cause their company damage by not doing this correctly – they accidentally blow out the flame.

There are some basic guidelines that can help make the new CEO stick.

1. Choose the New CEO Very Carefully. This is where most startups make the wrong choice. They base their choice on the wrong criteria and/or a limited pool of candidates, or peer pressure, or using one of the investors, etc. Be methodical and objective here. Engage experts if possible.

2. Put The Egos Away – mMake sure everyone is on board and understands that the new CEO is the right answer, including the outgoing CEO. Outgoing CEOs who can’t let go are one of the top reasons early stage companies fail at this process.

3. No Sacred Cows – Allow the new CEO to make the changes he/she wants mmediately. This requires trust on the part of the extant management team but you must let them manage the whole puzzle, not just parts of it (see #1).

f these things are done correctly the succession process can actually be a great experience for all involved. If you would like to discuss further please contact me. @tomnora

by tomnora | Feb 25, 2011 | CEO Succession, Revenue Growth

Long Term Stable Growth

There is much fascinating debate these days about Google(GOOG) vs. Facebook, reminiscent of some of the greatest battles in Silicon Valley over the past 40 years. In these two we have a classic Silicon Valley clash of the titans, meaning we can’t predict a winner, or even if there will be one. This battle has very high stakes for both. Googles current valuation is $200 billion; Facebook is estimated at $50 billion – both big numbers that have continuously soared since their early days. History says the eventually one or both of those numbers will go down, based on which of these two has the leadership to maneuver through the battlefield into more stable, balance long term growth.

First, Google

Google is the older, more mature of the 2, with a much wider footprint, domination of the Internet users life, a new way of thinking by maximizing freemium and claiming karmic high ground. The New Silicon Valley. They have also sustained growth for a decade, distinguishing them from 99% of Silicon Valley startups.

Of course, google has all the inherent problems of many years of success – bloat, too many products, too many markets, too many layers of management, too many employees, too much employee turnover, major fixed expenses, bureaucracy, fading of their “hipness factor”, aging architecture and growing insecurities about their position as King of the Hill. Classic. As long as net income continues to grow, they can overlook or rationalize these problems, but the negative effect of the above issues will eventually hit them; it hits everybody. The magic trick is to come out the other side better. Swapping out their CEO could be a good or bad thing, but that’s often a nervous reaction on both sides of the boardroom table. Google is also too dependent on one source of revenue, ads, taxing one of the oldest rules in the book “Don’t get too much revenue from one place”.

So I believe Google will hit a wall and wobble over the next 3 years. They will make changes, restructure, sell some toys, start looking at numbers very carefully. The first phase will no longer work.

Now baby brother Facebook

Facebook, on the other hand, is the classic up and comer, the position Google was once in. Not just a lucky little brother, but an extremely competent, precocious adolescent that has invented something totally new from what existed. They have thus far methodically monetized and structured their revolution for long term growth better than pioneers like Netscape did in the 1990s. they discovered something that everybody wants, and Mark Zuckermann is proving to be a true long term leader.

But they are a revolution currently, and revolutions eventually end, settle back into normal life. Facebook’s challenge will be to make that transition without stumbling. How will they diversify past their main product once it gets a little tired and some day surpassed? Can they? Facebook’s success has come from a multi-year rollout of membership to their club, one product. Brilliant product. Nothing has grown around the world like this since Coca Cola. There is still plenty of territory to roll out to, but the clock is ticking. What is the follow-on act? This is a tough one to pull off. They may do it, I don’t underestimate Zuckerberg and his team, but it will be very difficult not to become another MySpace or Yahoo.

Google vs. Facebook = Expansion vs. Rollout

So who will win the growth war here? Even if they’re smart enough not to harpoon each other these two companies will be very busy over the next 2-3 years surviving and continuing to grow.

They both have a strong chance, but if I had to pick one it would Google.

Here’s why: Google has a diversified platform with many market leading products (because they are better products) in very competitive markets – Search, Mail, Mobile, App Dev Tools, Image, Storage, Video, Statistics, and Advertising. Google had to overcome existing leaders in every one of these markets.

Facebook, on the other hand, invented their own product and market, and nobody has been able to catch up, not even Google. But in many forms their piece of the pie chart will decrease over time as different services reinvent their market for them. They must shift from rollout to diversification, or face the bell curve.

Like Google, Facebook also is overly dependent on ad revenue, breaking the same rule of growth and stability, and we don’t actually know how stable their revenue/profit curves are. Whatever the numbers, Facebook will have to reinvent itself and break some molds soon without hiccups in their revenue growth. I’m rooting for them, but this seldom happens. Unless you’re Google.

by tomnora | Feb 1, 2011 | founder, startup CEO

The last blog entry I wrote [Who’s the Boss? What is a CEO?] made me think about overall business decisiveness and it’s critical role in growing a startup properly. There are many synonyms and attributes of decisiveness – certainty, determination, finality, resolve, authority. But there’s no single formula or magic combination for this quality.

Decisiveness is one of the key skills for the leader of a startup to succeed; not everyone involved, but definitely the leader/CEO. It’s fine if you’re not that type, just be honest about it and find someone to take role. An indecisive leader will get run over by the crowd quickly and lose the respect of those around him/her; better to let someone else run the show and focus on another task.

A strong CEO in an active startup should be making and implementing several decisions every day. The job of CEO of a real operating company includes many lonely times, no matter how many people surround you. But no matter what, the bullseye in on your head.

For most strong leaders decisiveness is an innate quality, a feeling of empowerment and confidence that comes from somewhere within as well as the support of those around you. Some people are just born with it, or into it. A great example is Sophia Amoruso.

You thrive on the pressure of making decisions. Inspiration comes from beating obstacles in your past, overcoming a hardship or two, intense desire to succeed, past (or current) poverty, or some other experience in life where correct decision making took you from bad to good. Also, a startup CEO is usually much more decisive in his/her 2nd or 3rd startup than the first. They’ve “been there before”, understand the forks in the road, have been hardened and/or humbled a little by mistakes.

Lack of decisiveness at the top impedes growth. Lack of decisiveness running a startup usually is related to lack of experience, a different personality, or lack of desire to be that person. Can decisiveness be developed or taught? I think so. Self-confidence?

Probably not so easily acquired. I was quite lucky early in my career to have several great role models (and a few bad ones). Examples and proactive mentoring came from several places for me, some quite early in my career. I’m now trying to give back by advising others and mentoring startups.

So be decisive as the overall leader of your startup and surround yourself with support to make better decisions. Find mentors, delegate, let go of details. Or be honest with yourself if this isn’t you and find find someone qualified whom you trust to take that role and let them run with it.

Your startup will be the winner.

Find me on Twitter.