by tomnora | Jul 27, 2011 | early stage, founder, Revenue Growth, Scalability, startup, startup CEO

Aurum Rex. Nummus Rex. Emptor Rex.

I.e. Cash Is King. An old sayings, but so true in the startup growth equation. Where does revenue fall here? Is it more or less important? What about Strategy? Revenue? Growth? Buzz? Profit? A “Right On” product?. Smart People? Ambition? Your position on the Bell Curve?

When a startup has none, cash seems like liquid gold that can flow over the business and cure all – salaries, resources, exposure, growth, success, new offices, marketing. But often entrepreneurs fool themselves into thinking that lack of cash is their only problem. I’ve been involved or almost involved in so many early stage companies that said “If only we had $XXX in cash, everything would be o.k. Sometimes they get the new cash but still can’t scale or survive. Cash is certainly required to play, but it has to be part of a larger system, purpose, goal.

Venture capitalists, controllers of cash, are always looking for mind blowing new things that can “change the world”; can step out in front of our regular world and catch fire, anticipate what the world needs that no one else has figured out yet. And they have cash, high risk cash, to take a shot at being part of these new phenomenons. They get in early and guess at the future, which means they could be often wrong. But that’s not a problem; they only have to be right once in a great while to win big. That’s the game they’re in. What an exciting job!

On the other side we have the yet-to-be-funded or need-more-funding startup. Whatever cash is in this company is less than enough to spark it to the next level quickly enough to meet the business goals, or often just to make the next few payrolls. Is this you?

So what about REVENUE? Revenue is close to cash in it’s power within a startup. It can solve so many problems, including cash issues. It attracts more cash investment, it creates profits, it legitimizes your business. Revenue has to be managed properly and leveraged wherever possible, but those are good problems to have. It’s eventually more important than cash, especially when it’s steadily and predictably growing. Growing revenues, not cash, create higher valuations.

Early on, most startups focus more on adoption, eyeballs, users, traffic, assuming these will infer and convert to future revenue (Twitter, Google, Zynga, Facebook). The actual cash on hand and/or revenues don’t fully support the business, but no problem if major growth is apparent.

So is that it? User adoption? For Twitter it is, they’re currently at a valuation of 40X revenues, way high. But there’s no question that they’re permeating the globe, possibly with more longevity than Facebook.

The bottom line is value. What value, how many valuable things is your company providing. What’s better, cheaper, faster, unique, easier. Google is a great example of amazing and increasing value to user. It’s all of the above, mostly free, with an attitude of always wanting to provide more to its users while simultaneously simplifying use of everything digital.

Early on Google didn’t focus much on cash or revenue; they eschewed it, they had a higher goal – organize all the worlds information. Their goal and execution of it was most important to them. Of course they also happened to be a few blocks away from the highest concentration of venture capitalists on the planet, but they went 3 years without VC funding. Their first 2 years they had no revenues and received only $100K in funding, from Andy Bechtolsheim. A year later they raised $25 million. Their great ideas and excellent execution came before any cash.

So maybe cash shouldn’t be #1 for an ambitious startup, rather amazingness should, true passion, even if it’s nights and weekends around your day job.

@tomnora @cowlow @norasocial

by tomnora | Jul 19, 2011 | founder, Scalability

From July 2011,,.

California. Most of my 25 year career has been in California; about half of those in Silicon Valley. I’ve been involved with several amazing companies throughout Northern and Southern Cal; I have expanded, launched, M&A’d, relaunched, liquidated, succeeded and failed, you name it.

I’ve also had the good fortune to operate and sometimes live in several other fledgling tech corridors – Cambridge, NYC, Portland, Boulder, Santa Fe, Austin, Dallas, SLC, Frankfurt, Paris. In every case these other places aspire to be a self sustaining baby Silicon Valley of their own – Silicon Alley, Silicon Prairie, Silicon Coast. But they don’t quite make it. Some come close, like New York or now Boulder but it’s still not quite the same.

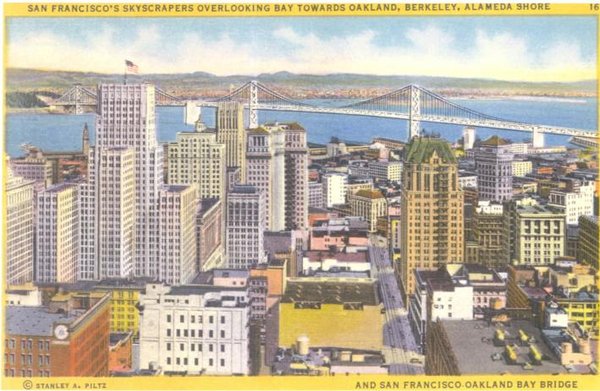

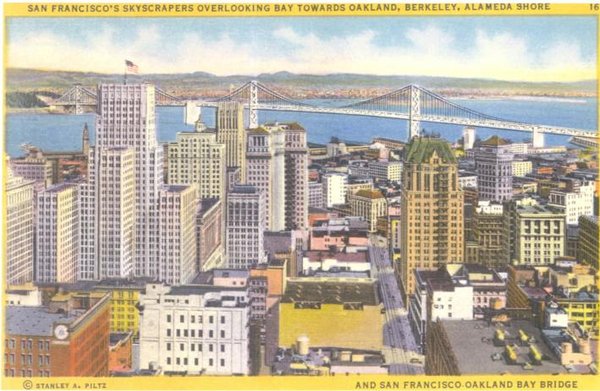

The term Silicon Valley is now a misnomer – it has moved way beyond silicon and way beyond the original Santa Clara valley to spread all over California. The new hot spots are San Francisco, Los Angeles, San Diego, the east bay, etc.

San Francisco

San Francisco has actually successfully co-opted the Silicon Valley magic and even surpassed it in some ways (Twitter, Salesforce.com); it’s again a very hot place to be right now and this will continue. Talk about scalability! If you plop your company here, great things could happen. It wasn’t always that way – in the 80’s and much of the 90’s San Fran was a sub-par runner up to SV, trying to catch up. Great PR and finance firms, but not many startups. Houses were cheaper, you couldn’t get good engineers, etc. That has all changed. Now companies have bidding wars for office space amid a major national recession.

There’s a magic and complex dynamic to the combination of things that make California so different. Just say the word and people take notice. There’s a seriousness, a buzz, confidence, reliability, completeness, professionalism. An assumption that you’ll more likely make it there.

Southern California

The “Silicon Basin” – – With the convergence of social media, the Internet, and digital entertainment, Southern California is now humming as a great startup region. In 2003 Electronic Arts actually moved their headquarters from Silicon Valley to Playa Vista, an crazy move at the time, and accelerated their growth as a result. Several smaller software groups, vfx studios and creative design labs are now benefitting from the movement south. Yahoo, Microsoft, Facebook, Google and others are growing their employee base and presence in L.A. Venture Capital from Northern and Southern Cal is flowing into the L.A. basin. It has the key catalyst – several excellent universities spitting out young engineers and business people. It has a strong and growing angel investor base, tapping one of the largest concentrations of individual wealth in the world.

There are exceptions to the California phenomenon; several amazing companies have emanated from these other areas, always have, and many of these ecosystems are now of course self sustaining, but they’re not the same as California. Countless companies have moved there for this advantage, reference Mark Zuckerberg/Facebook. Good move. If you’re somewhere else, it’s because you’ve made a tradeoff, a compromise. I know as I’ve done it myself several times and I’m glad I did. I’ve rooted for other places to approach California’s ecosystem, but I know they’ll never come close.

If you want maximum scalability for your business, you should be in California. If you the best capital providers, the best people, the highest valuations, you gotta be in Cali. You could get more advantages from a couple of visits to a coffee shop in Palo Alto than spending a year in some other town. @tomnora @cowlow

by tomnora | Feb 3, 2011 | startup CEO

Orrick Startup Kit

by tomnora | Feb 1, 2011 | founder, startup CEO

The last blog entry I wrote [Who’s the Boss? What is a CEO?] made me think about overall business decisiveness and it’s critical role in growing a startup properly. There are many synonyms and attributes of decisiveness – certainty, determination, finality, resolve, authority. But there’s no single formula or magic combination for this quality.

Decisiveness is one of the key skills for the leader of a startup to succeed; not everyone involved, but definitely the leader/CEO. It’s fine if you’re not that type, just be honest about it and find someone to take role. An indecisive leader will get run over by the crowd quickly and lose the respect of those around him/her; better to let someone else run the show and focus on another task.

A strong CEO in an active startup should be making and implementing several decisions every day. The job of CEO of a real operating company includes many lonely times, no matter how many people surround you. But no matter what, the bullseye in on your head.

For most strong leaders decisiveness is an innate quality, a feeling of empowerment and confidence that comes from somewhere within as well as the support of those around you. Some people are just born with it, or into it. A great example is Sophia Amoruso.

You thrive on the pressure of making decisions. Inspiration comes from beating obstacles in your past, overcoming a hardship or two, intense desire to succeed, past (or current) poverty, or some other experience in life where correct decision making took you from bad to good. Also, a startup CEO is usually much more decisive in his/her 2nd or 3rd startup than the first. They’ve “been there before”, understand the forks in the road, have been hardened and/or humbled a little by mistakes.

Lack of decisiveness at the top impedes growth. Lack of decisiveness running a startup usually is related to lack of experience, a different personality, or lack of desire to be that person. Can decisiveness be developed or taught? I think so. Self-confidence?

Probably not so easily acquired. I was quite lucky early in my career to have several great role models (and a few bad ones). Examples and proactive mentoring came from several places for me, some quite early in my career. I’m now trying to give back by advising others and mentoring startups.

So be decisive as the overall leader of your startup and surround yourself with support to make better decisions. Find mentors, delegate, let go of details. Or be honest with yourself if this isn’t you and find find someone qualified whom you trust to take that role and let them run with it.

Your startup will be the winner.

Find me on Twitter.

by tomnora | Feb 1, 2011 | CEO Succession, early stage, founder, Revenue Growth

I had dinner recently with a former colleague and good friend, let’s call him Al, who has recently transitioned from CTO to CEO of an early stage company he founded; he’s struggling with every aspect of his new job. Al was originally the de-facto leader through his first funding round, then at the urging of many around him recruited an experienced CEO to “take it to the next level”. Potential investors, former bosses, and current shareholders felt this was a critical step in for them to invest more time or money. The common line was “You’re not a CEO”. The new CEO was performing well, hitting milestones, preparing new funding and building the business, but he and Al couldn’t get along.

So now Al is now back in charge. This happens often in the early stages, sometimes because the new CEO is a bad match, but that’s usually just an excuse. Usually the CEO leaves for good or bad reasons, or the founder can’t let go of control of the company. In this case it was the latter. Als investors and employees are quite unhappy and he’s not sleeping much.

In hearing his frustrations I figured out his main problem – he’s having serious problems making decisions and sticking with them, which is why he brought in a professional CEO in the first place. He has no reference point for many key decisions so lacks the confidence to execute decisions. His frustration is that this doesn’t happen to him in technical matters – he’s brilliant at those decisions. Technical leaders frequently underestimate the job of the CEO or business leader in a fledgling startup. They use the logic – hey, I’m extremely smart, so marketing, sales, and business development can’t be as hard as developing an entire software platform. This is a big mistake, and a common reason why startups never get out of the gate.

I’ve been the incoming CEO several times in early stage startups, taking over for the founder. This transition is difficult to pull off, but necessary for many companies to scale. Emotionally it’s very hard for a founder to “let go” and trust an outsider to care as much as he/she does about their baby. There are also others around the founder that can feel ownership and impede the new CEO – a spouse, other early employees, a displaced senior manager who thought he/she had a shot at the job. I’ve experienced all of these situations, but I’ve also had many good experiences where I did have sponsorship and support, and succeeded.

In Al’s case, he never really committed himself to stepping aside, even though he said the words. He admits that now. In his actions he inadvertently sabotaged his new partner, changing the CEOs decisions without discussion, etc. He felt that the new CEO was making “too many” decisions. He obviously wasn’t ready. I realize that he still isn’t ready.

The reason for our meeting was to see if I was interested in the job – he feels that our long term relationship would provide the foundation for a successful transition, but I know it wouldn’t work. I explained to him what CEO means to me – the final decision maker in a company, answerable to a real Board of Directors, of which the founder is a member but not the only member. The E in CEO stands for execution, making things happen, responsible for the results. The CEO must communicate clearly to everyone involved what he/she is doing, especially if taking over the reins from a founder, but should be supported by all as the final major decision maker. If that process works, the company works. Without that authority they become ineffective quickly and are only doing portions of the job, and can’t take full responsibility; then they leave and you have to start all over.

I explained to Al two reasons why I wouldn’t join his company: 1) With all due respect, I don’t feel that he’s any more ready to let go than he was a year ago, even though he respects my abilities and has comfortably worked for me before, and 2) the company is distressed now, unhappy employees, unhappy investors, delays in both the business and technical initiatives, messy equity stakes and a decrease in trust all around. Like I said, a Big Mistake. I told him his best chance is to try to learn how to be a CEO or merge his company as fast as possible. But this one is most likely kaput.